In everyday language, the word “account” might remind you of a bank account or a social media profile. But in the world of accounting, the meaning is much more specific – and very important for tracking business performance.

An account is a detailed record of financial transactions related to a specific item. This could be cash, inventory, rent, sales, or any other item a business deal with. Whether you’re running a small shop or managing a large company, accounts are at the heart of good financial management.

Let’s take a closer look at what an account is, how it works, and why every business relies on it.

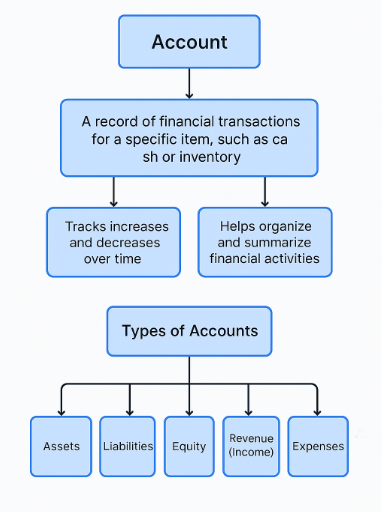

What Exactly Is an Account?

An account is like a folder that holds all the activity for one specific item. For example, if you have a “Cash” account, it records every time money comes in or goes out. If you have an “Inventory” account, it keeps track of the stock you buy and sell.

Each version shows how much has increased or decreased over time. This helps businesses understand their financial position and performance in an organized way.

Why Are Accounts So Important?

Accounts are essential in accounting because they help you stay in control of your finances. Here are a few key reasons why:

1. They Help You Track Financial Activity

With accounts, you can see exactly where your money is coming from and where it’s going. For example, you can review your “Sales” account to see how much revenue you earned this month. Or you can check your “Utilities” account to see how much you’ve spent on electricity and internet.

2. They Help You Make Better Business Decisions

If your accounts are well-organized and accurate, you can make smarter decisions. For instance, you might notice that your “Expenses” account is growing faster than your “Revenue” account, which means it’s time to reduce costs or increase sales.

3. They Help You Meet Legal and Tax Requirements

Businesses must provide financial reports to government agencies, banks, or investors. These reports are built using the information recorded in your accounts. If your accounts are incomplete or inaccurate, your reports will be unreliable and that could lead to fines or missed opportunities.

4. They Provide a Clear Picture of Your Business

With all the information in one place, accounts help you see the big picture. Are you making a profit? Are you spending too much? Do customers pay on time? Your accounts hold the answers.

Common Types of Accounts

To understand accounts better, let’s explore the different types that appear in accounting. Each one serves a different purpose and represents a different part of your business.

1. Asset Accounts

These accounts track what your business owns. Assets include things like cash, inventory, equipment, and money owed to you by customers. For example, a “Cash” account records all your money in the bank, while an “Accounts Receivable” account tracks unpaid customer invoices.

2. Liability Accounts

Liabilities are what your business owes to others. Common liability accounts include loans, unpaid bills, or taxes you still need to pay. For example, an “Accounts Payable” account records all the money you owe to suppliers.

3. Equity Accounts

Equity represents the owner’s interest in the business. It includes the money you invest into the business, as well as profits that are kept in the company rather than paid out.

4. Revenue Accounts

Revenue accounts track money coming into the business from sales of goods or services. A “Sales” account, for example, records every time you make a sale.

5. Expense Accounts

These accounts show how much your business spends to operate. This includes rent, salaries, advertising, office supplies, and more. If you pay rent every month, you record it in your “Rent Expense” account.

How Do Accounts Work in Practice?

Let’s break this down with a simple example.

Imagine you open a small coffee shop.

- You deposit $5,000 of your own money into the business. That increases your “Cash” account and also increases your “Owner’s Equity” account.

- You buy coffee beans and supplies for $1,000. That reduces your “Cash” account and increases your “Inventory” account.

- You sell coffee to customers and earn $3,000. That increases both your “Sales” and “Cash” accounts.

- You pay $800 for rent. That increases your “Rent Expense” and reduces your “Cash” account.

Each of these transactions affects at least two accounts. This system of recording two sides of every transaction is known as double-entry accounting, and it’s the foundation of modern bookkeeping.

Organizing Accounts with a Chart of Accounts

Every business uses a list called a Chart of Accounts. This list includes all the accounts used in the business and helps keep everything organized. Each account has a name and often a number for easy reference.

Some examples include:

- Cash

- Accounts Receivable

- Sales

- Marketing Expense

- Salaries Expense

- Utilities

- Owner’s Equity

When you use accounting software, this list is usually built in. All you have to do is select the correct account when entering a transaction, and the software updates everything automatically.

Common Mistakes to Avoid

Here are a few common errors people make when managing accounts:

- Recording an expense as an asset (for example, treating a supply purchase as equipment).

- Forgetting to enter small transactions like petty cash expenses.

- Using vague or unclear account names, which leads to confusion later.

- Not checking bank balances or reconciling accounts regularly.

These mistakes can lead to incorrect reports, missed tax deductions, or even financial losses. Staying consistent and paying attention to detail can make a big difference.

Final Thoughts

An account may seem like a small part of accounting, but it plays a huge role. It helps track every financial movement in your business , from the money you earn to the money you spend. When properly maintained, your accounts give you a reliable picture of where your business stands today, and where it’s headed tomorrow.

If you’re new to accounting, take time to learn the basics. If you’re already running a business, make sure your accounts are kept up-to-date and reviewed regularly. Clear, well-organized accounts are the key to a financially healthy and successful business.