Navigating the intricacies of New Zealand’s tax system can be challenging, especially when it comes to understanding which deductions you’re entitled to claim. Properly claiming deductions can significantly reduce your taxable income, leading to potential tax savings. At Aurora Financials, we specialize in providing remote accounting and audit services to clients across New Zealand, ensuring you maximize your eligible deductions while remaining compliant with Inland Revenue Department (IRD) regulations.

Understanding Tax Deductions in New Zealand

Tax deductions are specific expenses that the IRD allows you to subtract from your total income, thereby reducing your taxable income. By claiming these deductions, you can lower the amount of tax you owe. However, it’s crucial to ensure that any expenses you claim are legitimate and directly related to earning your income.

Common Deductible Expenses for Individuals

While New Zealand’s tax system is primarily designed to tax income at its source, there are several expenses that individuals may be eligible to deduct:

1. Income Protection Insurance Premiums

If you have an income protection insurance policy where any payouts are considered taxable income, the premiums you pay for this insurance are deductible. This means you can claim these premiums as an expense on your tax return. It’s advisable to consult with your insurance provider or a tax professional to confirm the deductibility of your specific policy premiums.

2. Tax Preparation Fees

The costs associated with hiring a professional to prepare and file your income tax return are deductible. This includes fees paid to accountants or tax agents for their services. By claiming these expenses, you can reduce your taxable income.

3. Charitable Donations

Donations made to approved charitable organizations can qualify for a tax credit. To be eligible, the donation must be a voluntary gift of money, and the organization must be an IRD-approved done. You can claim a tax credit of 33.33% of the total donations you made during the tax year, up to the amount of your taxable income.

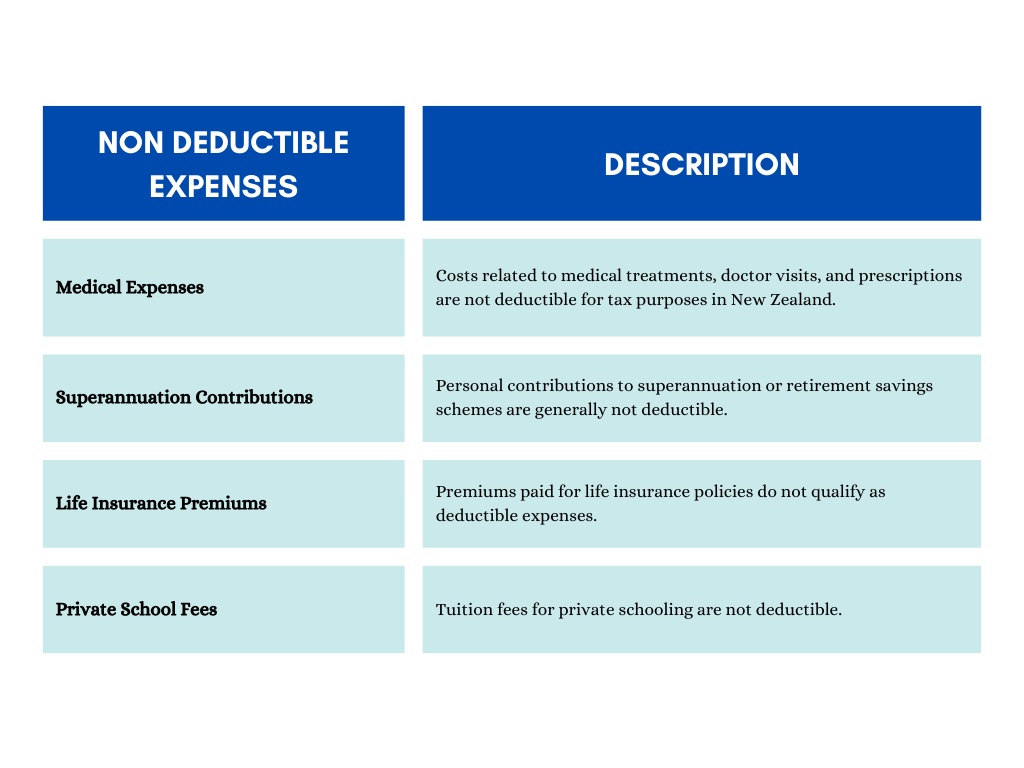

Expenses That Are Generally Non-Deductible

It’s equally important to be aware of expenses that are typically not deductible:

Understanding these distinctions helps ensure that you only claim legitimate deductions, reducing the risk of errors on your tax return.

Maximizing Your Deductions: Best Practices

To make the most of the deductions available to you, consider the following best practices:

1. Maintain Accurate Records

Keep detailed records of all your income and expenses throughout the year. This includes invoices, receipts, and any other documentation that supports your claims. Organized records make it easier to substantiate your deductions if the IRD requests evidence.

2. Stay Informed About Tax Law Changes

Tax laws and regulations can change, affecting which deductions are available. Regularly reviewing updates from the IRD or consulting with a tax professional can help you stay informed about any changes that may impact your tax return.

3. Consult with a Professional Accountant

Engaging with a professional accountant or tax advisor can provide personalized guidance tailored to your specific financial situation. At Aurora Financials, we offer remote accounting and audit services to clients across New Zealand, ensuring you receive expert advice no matter where you’re located.

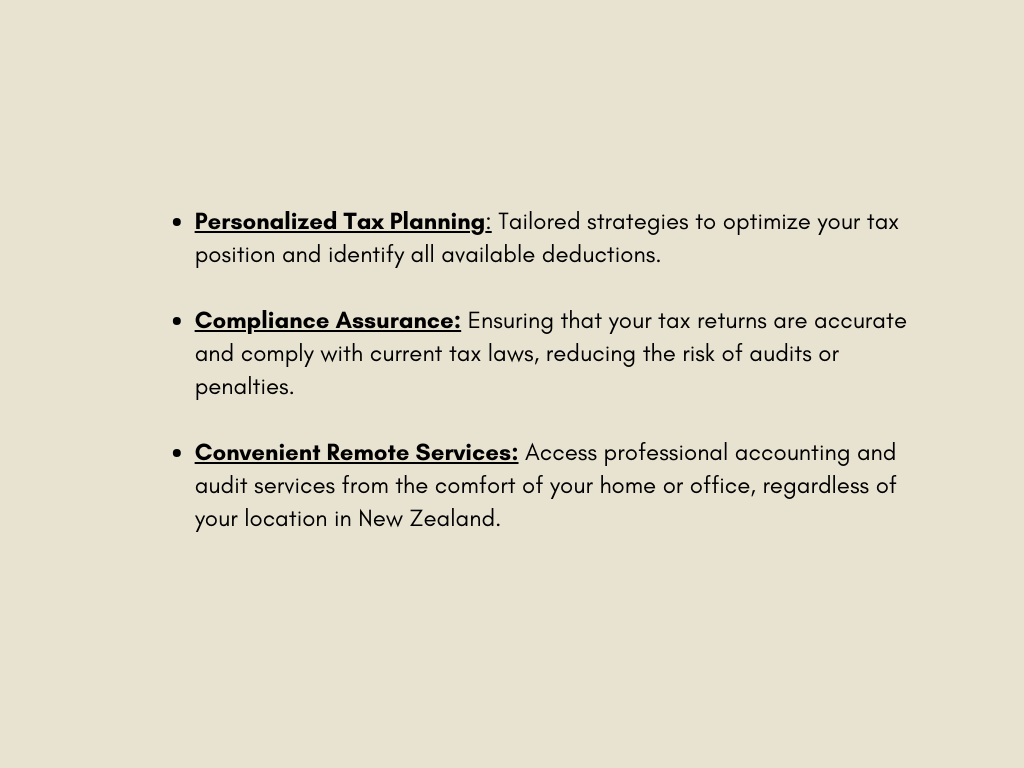

How Aurora Financials Can Assist You

At Aurora Financials, we understand the complexities of New Zealand’s tax system and are committed to helping you navigate them effectively. Our remote accounting and audit services are designed to assist clients throughout the country in maximizing their eligible deductions and ensuring compliance with all tax regulations.

By partnering with us, you can benefit from:

Conclusion

Effectively claiming deductions on your individual tax return can lead to significant tax savings. By understanding which expenses are deductible, maintaining accurate records, and seeking professional guidance, you can optimize your tax position. Aurora Financials is here to support you with expert remote accounting and audit services, ensuring you navigate the tax season with confidence and ease.

Frequently Asked Questions (FAQs)

Q1: Can I claim home office expenses as an individual taxpayer?

A1: Home office expenses are generally deductible for self-employed individuals or those running a business from home. If you’re an employee working from home, you may be eligible to claim certain expenses if they are necessary for your employment and not reimbursed by your employer. It’s advisable to consult with a tax professional to determine your eligibility.

Q2: Are childcare expenses deductible on my tax return?

A2: Childcare expenses are not deductible for tax purposes in New Zealand. However, there may be other forms of government assistance available to help with childcare costs.

Q3: How do I claim a tax credit for charitable donations?

A3: To claim a tax credit for charitable donations, ensure that the organization is an IRD-approved done. Keep all donation receipts and submit a Tax Credit Claim Form (IR526) to the IRD, along with your receipts, after the end of the tax year.

Q4: What should I do if I’m unsure about the deductibility of an expense?

A4: If you’re uncertain whether an expense is deductible, it’s best to consult with a professional accountant or tax advisor. They can provide guidance based on current tax laws and your specific situation.

Q5: Can I amend my tax return if I forgot to claim a deduction?

A5: Yes, if you realize that you’ve omitted a deductible expense after filing your tax return, you can request an amendment through the IRD’s myIR online portal or by contacting the IRD directly.