New Zealand’s healthcare sector plays a crucial role in protecting and improving the quality of life for all residents. From public hospitals and aged care facilities to mental health providers and clinics, the demand for transparency and accountability in the healthcare system continues to grow. To maintain high standards of service and compliance, organizations increasingly rely on healthcare audit firms.

These specialized firms assess whether healthcare providers are financially responsible, compliant with New Zealand laws, and operating efficiently. In this article, we explore the role of healthcare audit firms in New Zealand, the services they provide, how the audit process works, and how organizations can benefit from engaging them.

What Are Healthcare Audit Firms?

Healthcare audit firms are professional service providers that conduct audits tailored to the needs of healthcare organizations. These audits go beyond financial reviews to include operational assessments, regulatory compliance checks, data security evaluations, and service delivery quality reviews.

Unlike general auditors, healthcare audit firms are familiar with the complex environment in which medical providers operate. They understand the intersection between healthcare regulations, public funding, staff obligations, and clinical service delivery. In New Zealand, these firms often work with clients such as public hospitals, aged residential care facilities, Māori and Pasifika health services, rehabilitation centers, and mental health providers.

Why Healthcare Providers Need Audits

Healthcare providers handle public funding, sensitive personal data, and essential services. This makes them subject to strict accountability standards. Regular audits help ensure that providers:

- Use funding responsibly and in line with contractual obligations

- Meet industry standards such as NZS 8134:2021 for health and disability services

- Maintain accurate payroll and billing systems

- Comply with legislation like the Privacy Act 2020 and the Holidays Act 2003

In many cases, audits are not optional. For example, aged care providers must be audited for certification. Publicly funded organizations may be required to submit audited financial statements to the Ministry of Health or Te Whatu Ora.

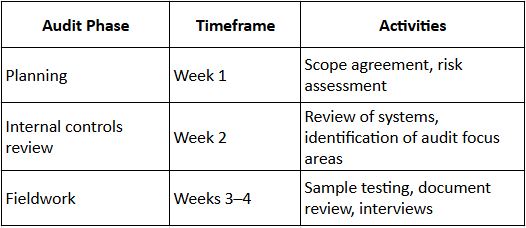

Services Offered by Healthcare Audit Firms

Healthcare audit firms in New Zealand offer a broad range of services that address both financial and non-financial aspects of operations. These services are delivered based on risk assessments, contract terms, and sector-specific obligations.

1. Financial Audits

These are designed to verify that financial statements are accurate, complete, and compliant with New Zealand accounting standards such as NZ IFRS or PBE standards. Auditors review income sources, expenses, assets, liabilities, and disclosures.

2. Compliance and Certification Audits

Healthcare audit firms check whether organisations meet the required standards for certification or licensing. This includes auditing clinical care records, service delivery models, and health and safety policies, particularly in aged care or disability support services.

3. Payroll and Entitlements Reviews

Given the complexity of shifts and rosters, payroll systems in the healthcare sector are prone to errors. Auditors check that wages are calculated correctly, entitlements are accurate, and records comply with employment laws.

4. Privacy and Information Security Audits

Patient information is sensitive and must be handled with care. Healthcare audit firms test systems for privacy compliance under the Privacy Act 2020 and assess risk areas related to cybersecurity and data breaches.

5. Operational and Internal Control Reviews

These reviews assess how well an organization’s internal systems operate—ranging from procurement processes to inventory controls. The goal is to identify risks and suggest improvements.

Table 1: Common Services Provided by Healthcare Audit Firms

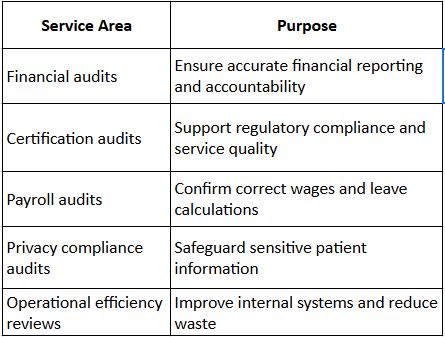

How the Audit Process Works

When a healthcare provider engages an audit firm, the process follows a series of structured steps. Each phase is designed to gather information, assess performance, and provide assurance to stakeholders.

Step 1: Scope Definition and Engagement

The process starts with defining the audit’s scope. The organisation and the audit firm agree on what will be audited—financial statements, clinical processes, payroll systems, or all three. An engagement letter outlines the roles, timelines, and expected deliverables.

Step 2: Preliminary Understanding

Auditors begin by understanding the nature of the healthcare service, funding sources, management structure, and any previous audit issues. This background helps them tailor the audit to focus on areas with higher risks.

Step 3: Internal Controls Review

Healthcare audit firms assess the organisation’s internal control systems. This includes how payments are approved, how data is secured, and how services are monitored. Weak controls can expose the organisation to fraud, errors, or legal risks.

Step 4: Sample Testing

Auditors select samples of financial transactions, patient files, payroll entries, or contracts. These are tested for accuracy, compliance, and completeness. For example, billing records might be checked against treatment notes to ensure charges are valid.

Step 5: Onsite or Remote Fieldwork

Depending on the audit type, the auditors may visit the site or conduct remote audits. They collect evidence, interview staff, and review documentation. In aged care audits, this could include observing care practices or inspecting facility safety.

Step 6: Audit Reporting

After fieldwork is complete, the auditors compile a report detailing their findings, risks, and recommendations. The report may include management feedback and is submitted to the board, the regulator, or funding agencies, depending on requirements.

Table 2: Example Timeline of a Healthcare Audit Process

Key Regulations Healthcare Audit Firms Must Follow

In New Zealand, audits of healthcare providers must comply with various regulatory and reporting requirements. These include:

- NZS 8134:2021 – Standards for health and disability services

- PBE Standards – Accounting rules for public benefit entities

- Privacy Act 2020 – Guidelines for collecting and managing personal data

- Holidays Act 2003 – Requirements around staff leave and pay

- Employment Relations Act 2000 – Covers employment contracts and workplace practices

A good healthcare audit firm stays up to date with changes in law and sector standards. Their reports often guide organisational improvements to meet these regulations.

Benefits of Engaging Healthcare Audit Firms

Partnering with a qualified audit firm brings many advantages beyond meeting legal obligations:

- Increased accountability – Demonstrates integrity to regulators, funders, and patients

- Improved decision-making – Audit insights help leaders manage risks and allocate resources better

- Operational clarity – Reveals inefficiencies and areas for process improvement

- Compliance assurance – Helps providers meet certification and contract terms

- Reputation management – Strengthens trust with stakeholders through transparency

These benefits are especially important in a sector where public funding and patient care are involved.

Choosing the Right Healthcare Audit Firm

Selecting the right audit partner is a critical decision. Not all firms are equipped to understand the nuances of the healthcare sector. Here are some factors healthcare providers should consider:

- Industry experience – Choose firms that specialise in healthcare audits

- Regulatory knowledge – Ensure the team understands NZ healthcare standards

- Communication – Look for firms that provide clear and timely feedback

- Reputation – Ask for references or case studies from similar clients

- Independence – Make sure the firm can offer unbiased assessments

Working with the right firm can make the audit process smoother and more beneficial to your organisation.

Conclusion

The New Zealand healthcare sector faces increasing demands for accountability, efficiency, and compliance. Healthcare audit firms play a vital role in meeting these demands by providing independent evaluations of financial practices, operational systems, and legal compliance.

Whether it’s a hospital preparing for annual reporting, an aged care facility renewing its certification, or a community health provider seeking better internal controls, audits provide clarity and confidence. Choosing a reputable healthcare audit firm ensures that organisations stay informed, aligned with regulations, and focused on delivering quality care.

As the sector continues to evolve, regular audits will remain a key part of good governance and public trust in healthcare.

Frequently Asked Questions (FAQs)

1. Are healthcare audit firms mandatory for aged care providers in New Zealand?

Yes, aged care providers in New Zealand are required to undergo audits for certification under NZS 8134:2021. These audits are essential for continuing to operate legally and receive government funding. Healthcare audit firms play a key role in these reviews by assessing clinical quality, safety standards, and compliance with sector regulations. Failing to meet audit requirements can result in reduced funding or loss of certification, so providers often work closely with audit firms to prepare and maintain compliance.

2. How are healthcare audit firms different from general audit firms?

Healthcare audit firms specialise in the healthcare sector and are familiar with the unique risks, standards, and regulations that govern it. While general auditors can review financial statements, healthcare-focused firms also assess compliance with NZS 8134, patient privacy protocols, and clinical procedures. Their knowledge of health-specific laws and funding contracts makes them more effective in identifying sector-relevant risks and offering actionable recommendations that general auditors may overlook.

3. How often should a healthcare organisation undergo an audit in New Zealand?

The frequency of audits depends on the type of organisation and its funding or licensing obligations. Publicly funded providers often require annual financial audits. Aged care and disability providers typically undergo certification audits every 1–4 years. Internal audits or specialised reviews, such as privacy or payroll audits, may be scheduled more frequently based on risk assessments or organisational changes. Engaging healthcare audit firms regularly helps ensure ongoing compliance and operational efficiency.