The landscape of bookkeeping services in NZ is rapidly evolving with the rise of automation, artificial intelligence (AI), and stricter compliance requirements. Businesses are shifting from traditional bookkeeping methods to cloud-based solutions that enhance accuracy, reduce costs, and ensure regulatory compliance. As technology transforms financial management, understanding the latest trends in bookkeeping services can help businesses stay ahead of the curve.

How Automation is Changing Bookkeeping Services in NZ

Automation has significantly improved bookkeeping efficiency, eliminating manual data entry errors and streamlining financial processes. Cloud-based software like Xero, MYOB, and QuickBooks now integrate AI-driven features that categorize transactions, generate reports, and reconcile accounts in real-time.

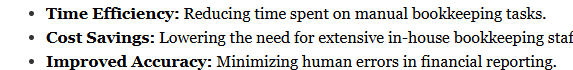

Businesses leveraging automation experience benefits such as:

AI and Machine Learning in Bookkeeping

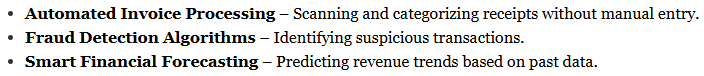

Artificial intelligence is reshaping bookkeeping services in NZ by offering predictive analytics, fraud detection, and smart financial insights. AI-powered tools analyze financial patterns, identify anomalies, and provide recommendations to improve cash flow management.

Key AI-Driven Features in Modern Bookkeeping:

Compliance Challenges in Bookkeeping Services

Regulatory requirements for bookkeeping services in NZ continue to evolve, with the IRD (Inland Revenue Department) enforcing stricter tax compliance standards. Businesses must ensure:

- GST and tax filings are accurate and submitted on time.

- Payroll records comply with the latest employment regulations.

- Financial statements align with New Zealand Generally Accepted Accounting Practice (NZ GAAP).

Failing to meet compliance obligations can result in penalties and financial setbacks, making professional bookkeeping services essential for businesses of all sizes.

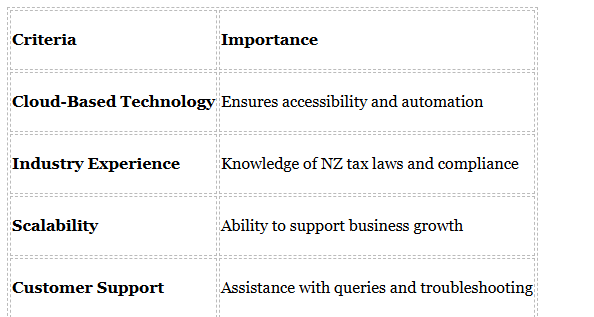

Choosing the Right Bookkeeping Service in NZ

With numerous options available, selecting the best bookkeeping service requires careful consideration of:

Conclusion

The future of bookkeeping services in NZ is driven by technological advancements and compliance demands. Businesses that adopt AI-powered tools and automated bookkeeping solutions can improve efficiency, reduce costs, and stay compliant with evolving regulations. As bookkeeping continues to shift towards digital transformation, choosing the right service provider will be critical for long-term success.

Frequently Asked Questions (FAQ)

1. What are the benefits of automated bookkeeping services in NZ?

Automated bookkeeping saves time, reduces human errors, and improves efficiency by streamlining financial processes.

2. How does AI impact bookkeeping services?

AI enhances bookkeeping by automating invoice processing, detecting fraud, and providing financial insights.

3. What compliance challenges do businesses face in bookkeeping?

Businesses must adhere to GST and tax regulations, maintain accurate payroll records, and comply with NZ GAAP standards.

4. What should businesses look for in a bookkeeping service provider?

Key factors include cloud-based technology, industry expertise, scalability, and customer support.

5. Will AI replace human bookkeepers?

While AI automates many tasks, human expertise is still needed for strategic financial planning and compliance management.