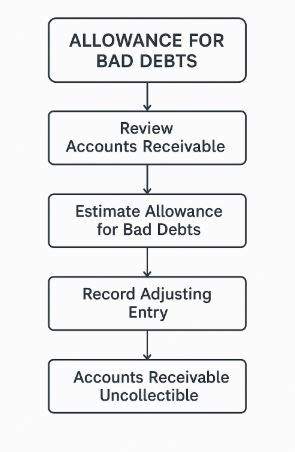

Allowance for bad debts refers to a financial estimate that businesses use to account for the portion of accounts receivable they expect not to collect. When a company sells goods or services on credit, not every customer will pay on time or at all. Rather than waiting for each customer to default, the company proactively sets aside a reserve based on historical trends or risk assessments. This reserve is called the allowance for bad debts or allowance for doubtful accounts.

The purpose of this allowance is to show a more accurate and realistic picture of a business’s financial health. It ensures that reported assets and net income are not overstated. This aligns with the accrual basis of accounting, which requires revenues and related expenses to be recognized in the same period.

Why Do Companies Use This Allowance?

Every business that offers credit to customers runs the risk of not getting paid. While this is a normal part of doing business, ignoring it can distort financial reports. If a company only records bad debts when they happen, it may end up reporting inflated profits in one period and unexpected losses in another. This leads to financial statements that don’t reflect the true performance of the business.

Using an allowance method helps companies:

- Estimate future losses in advance

- Provide more accurate financial reports

- Meet accounting standards

- Maintain credibility with investors, lenders, and auditors

How Is the Allowance Calculated?

There are two widely used methods to estimate the allowance for bad debts

Percentage of Credit Sales Method

This method applies a fixed percentage to the total credit sales for the period. The percentage is usually based on past experience or industry averages.

For example, if a business expects 3 percent of its credit sales to become uncollectible, and total credit sales for the month are $100,000, it will record a $3,000 bad debt expense.

Aging of Accounts Receivable Method

In this method, the business categorizes outstanding receivables based on how long they’ve been unpaid. Each category is then assigned an estimated uncollectible rate.

Older debts are generally considered more likely to become bad debts. For example, receivables 0 to 30 days past due might have a 2 percent risk, while those over 90 days might have a 20 percent risk.

The total allowance is calculated by applying the respective percentages to each age group and summing the results.

How the Allowance Appears on Financial Statements

The allowance for bad debts is recorded on the balance sheet as a contra-asset account. It is listed just below accounts receivable and reduces the total receivables to show what the company actually expects to collect.

If the total accounts receivable is $80,000 and the allowance is $5,000, the net realizable value will be $75,000. This amount gives investors and managers a clearer picture of future cash inflows.

Accounting Entries

When a business sets up or adjusts the allowance, it makes the following journal entry:

- Debit: Bad Debt Expense

- Credit: Allowance for Doubtful Accounts

This increases the expenses on the income statement and establishes the reserve on the balance sheet.

When a specific account is confirmed as uncollectible, the write-off entry is:

- Debit: Allowance for Doubtful Accounts

- Credit: Accounts Receivable

This removes the uncollectible amount from both the accounts receivable and the allowance, without affecting the income statement again.

Real-Life Example

Let’s say a company has $250,000 in outstanding receivables at year-end. Based on historical trends, it estimates that 4 percent may not be collected. The company records a bad debt expense of $10,000 and credits the same amount to the allowance for doubtful accounts.

Two months later, a customer defaults on a $1,500 invoice. The business writes off this specific amount by debiting the allowance and crediting the receivable account. The allowance is reduced to $8,500, and the net accounts receivable is still accurate.

Benefits of Using an Allowance for Bad Debts

- Improved Financial Accuracy

The allowance helps a company reflect the real value of its receivables. It avoids inflated assets and shows investors a more realistic position. - Better Budgeting and Planning

When businesses understand how much might not be collected, they can plan their cash flow, inventory, and operations more effectively. - Compliance with Accounting Standards

The accrual method requires matching income and expenses in the same period. The allowance method helps fulfill this rule. - Stronger Confidence in Reports

Investors, creditors, and auditors prefer financial reports that don’t hide risks. An accurate allowance builds trust in the company’s data.

Common Mistakes to Avoid

- Underestimating Bad Debts

This can overstate income and lead to cash flow problems if too many invoices go unpaid. - Overestimating Bad Debts

This may reduce taxable income unnecessarily and make the business look less profitable than it really is. - Not Reviewing the Allowance Regularly

Customer behavior and market conditions can change. Businesses should re-evaluate their allowance regularly. - Ignoring Early Warning Signs

Late payments, disputes, or customer financial trouble can signal growing risk. These should be factored into future estimates.

Allowance Method vs Direct Write-Off

Some businesses use the direct write-off method, where bad debts are only recorded once a specific invoice is known to be uncollectible. However, this method does not match expenses to the correct time period and may delay the recognition of losses.

The allowance method is considered more accurate and is preferred under generally accepted accounting principles (GAAP). It allows companies to anticipate and manage losses proactively, resulting in more stable financial reporting.

Summary

The allowance for bad debts is a key accounting tool that helps businesses deal with the reality of unpaid customer invoices. Instead of waiting until payments are missed, companies estimate and prepare for potential losses. This improves the accuracy of financial statements, supports better decision-making, and ensures compliance with accounting standards.

Businesses that regularly sell on credit should maintain an allowance for doubtful accounts as part of their standard financial practices. It reflects financial responsibility and prepares the company for future uncertainties.