What Is Accrued Interest?

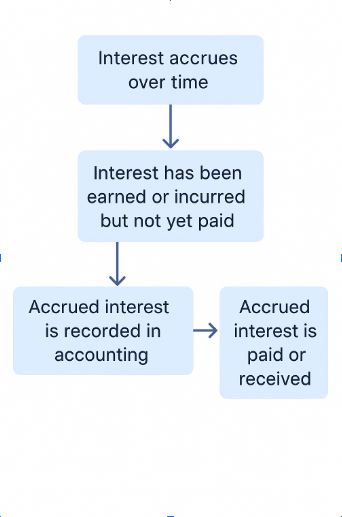

Accrued interest refers to the amount of interest that has accumulated on a loan or investment but has not yet been paid or received. It builds up daily from the time the interest starts to accrue until the moment it is settled.

This concept is important in both personal and business finance. For borrowers, it represents interest expense that is owed. For lenders or investors, it reflects interest income that is earned but not yet received.

In accounting, accrued interest is recorded even before any actual money changes hands. This ensures financial statements accurately reflect the true financial position at any given point in time.

Why Does Accrued Interest Matter?

Matching Income and Expenses to the Right Period

Accrual accounting relies on recognizing income and expenses in the period they occur, not when they are paid. Accrued interest helps maintain this accuracy by ensuring that interest is reflected in the correct accounting period.

Transparency and Accuracy in Financial Reporting

Recording accrued interest allows businesses to show a completer and more realistic picture of their finances. Without it, income and expenses could appear misleadingly low or high.

Better Loan and Investment Tracking

Both borrowers and lenders can benefit from tracking accrued interest. It helps with managing cash flow, understanding liabilities, and planning future payments.

Where Is Accrued Interest Used?

Accrued interest appears in many real-life financial scenarios, including:

- Business loans and lines of credit

- Bonds and other fixed-income investments

- Mortgages and consumer loans

- Corporate borrowing agreements

- Short-term or long-term investments

In each case, interest accrues day by day, even if payment is scheduled monthly, quarterly, or annually.

How Accrued Interest Works

Let’s look at a simple example.

Imagine a company borrows $100,000 at an annual interest rate of 6 percent. The lender requires quarterly interest payments. That means the company will pay $1,500 every three months.

However, after one month, even though no payment has been made, the company still owes $500 in interest. This $500 is accrued interest and must be recorded as an expense on the income statement and as a liability on the balance sheet.

Accrued Interest: Accounting Entries

In accounting, accrued interest must be recorded regularly to ensure financial reports are up to date.

For a borrower, the entries would be:

- Debit Interest Expense

- Credit Accrued Interest Payable

For a lender or investor, the entries would be:

- Debit Accrued Interest Receivable

- Credit Interest Income

These entries make sure the financial statements are correct, even if the actual payment is made at a later date.

How to Calculate Accrued Interest

The formula is straightforward:

Accrued Interest = Principal Amount × Interest Rate × Time

- Principal Amount: the original loan or investment amount

- Interest Rate: annual rate, written as a decimal

- Time: the portion of the year interest has accrued (for example, 30 days would be 30 divided by 365)

Example

If you lend $10,000 at an annual interest rate of 5 percent, and 30 days have passed since the loan began:

Accrued Interest = 10,000 × 0.05 × (30 / 365) = approximately $41.10

This means $41.10 is owed to you but not yet received.

Accrued Interest and Bonds

In the bond market, accrued interest is particularly important. When a bond is sold between interest payment dates, the buyer typically pays the seller the market price of the bond plus the accrued interest.

This ensures the seller is compensated for the interest earned during the time they held the bond. When the next interest payment is made, the full amount goes to the new owner.

This system keeps the bond market fair and accurate for both buyers and sellers.

Benefits of Tracking Accrued Interest

- Ensures accurate financial statements

- Helps with forecasting and budgeting

- Supports better decision-making for loans and investments

- Allows investors and businesses to monitor interest income and expense

- Aligns with accounting standards for accrual-based systems

Common Challenges

- Requires careful tracking, especially for multiple loans or investments

- Needs accurate time and rate calculations

- Can be overlooked during manual accounting processes

- May complicate reporting if not updated regularly

Using accounting software or spreadsheets helps reduce errors and ensures consistency.

Final Thoughts

Accrued interest is a vital concept in accounting and finance. It helps align financial reporting with real-world activity by recognizing interest as it builds up over time. Whether you are a business owner, accountant, lender, or investor, understanding accrued interest ensures that your financial records are timely, accurate, and complete.

By calculating and recording interest on a daily basis, companies gain better control over their cash flow, liabilities, and revenues. It is a simple idea, but one with wide-reaching impact.