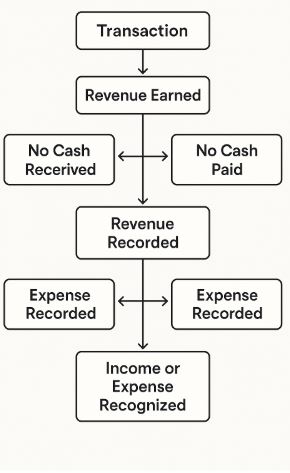

When you run a business, it’s important to know how much money you’ve earned and how much you’ve spent, even if the cash hasn’t changed hands yet. That’s where accrual accounting comes in.

Accrual accounting is a method used by businesses to record income and expenses when they are earned or incurred, not when the money is actually received or paid. It gives a more accurate picture of a company’s financial health than simply tracking cash.

Let’s break it down in a simple and easy-to-understand way.

What Is Accrual Accounting?

Accrual accounting is an accounting method where revenues are recorded when earned, and expenses are recorded when they happen, regardless of when cash is received or paid.

This means if you deliver a service today but receive the payment next month, you still record the income today.

Likewise, if you receive a bill this month but pay it next month, you still record the expense this month.

This method matches income and expenses to the time period in which they happen, giving a true picture of profitability.

Why Does It Matter?

1. Gives a Realistic Financial Picture

Since income and expenses are recorded when they actually occur, accrual accounting shows a more accurate view of a business’s financial condition.

2. Better for Long-Term Planning

Because it reflects when business activities really happen, it helps business owners plan better and understand trends in their operations.

3. Complies with Accounting Standards

Most countries, including those using IFRS or GAAP, require or recommend accrual accounting for larger or incorporated businesses. It is the standard method for financial reporting.

Accrual Accounting vs. Cash Accounting

To understand accrual accounting better, it helps to compare it with cash accounting, which is a simpler method.

- In cash accounting, income and expenses are only recorded when the money is actually received or paid.

- In accrual accounting, transactions are recorded when they occur, not when the money changes hands.

Here’s a simple difference:

- Accrual: You invoice a client in April and get paid in May. You record the income in April.

- Cash: You record the income in May, when the money is received.

Key Concepts in Accrual Accounting

1. Accounts Receivable

When a company earns money but hasn’t received it yet, it’s recorded as accounts receivable. This is an asset on the balance sheet.

2. Accounts Payable

When a company owes money to a supplier for goods or services already received, it records the amount as accounts payable, a liability.

3. Prepaid Expenses

If a company pays in advance for something (like rent), the payment is not counted as an expense immediately. Instead, it’s recorded as an asset and recognized over time.

4. Accrued Expenses

These are expenses that are recorded even though the payment hasn’t been made yet. For example, wages that are owed at the end of a month but will be paid next month.

Example in Simple Words

Let’s say you own a small design agency.

- In June, you finish a $10,000 project for a client and send them an invoice. They agreed to pay in July.

- You also receive a $1,000 bill from your printer in June, but you’ll pay them in July.

Using accrual accounting, your June profit would include the $10,000 income and the $1,000 expense, even though no cash has been received or paid yet. This helps show your real activity for June.

Who Should Use Accrual Accounting?

Accrual accounting is typically used by:

- Medium and large businesses

- Companies that carry inventory

- Businesses that offer credit terms to customers

- Businesses required by law or accounting standards to prepare accrual-based financial statements

Smaller businesses may choose cash accounting for simplicity, but accrual accounting provides more insight into how the business is performing.

Benefits of Accrual Accounting

- More accurate profit reporting

- Better matching of income and expenses

- Helps investors and lenders understand business health

- Useful for tracking long-term contracts or projects

- Required for audited financial statements

Challenges of Accrual Accounting

- More complex to manage than cash accounting

- Requires tracking receivables and payable

- May show profit when there’s no cash in hand

- Needs proper accounting software or professional help

Because of these challenges, many businesses use accounting software that automates accrual tracking and reporting.

Why It’s Used in Financial Reporting

Most financial statements prepared for investors, tax authorities, or regulators are based on accrual accounting because it provides a consistent and complete view of business operations.

Without accrual accounting, it would be harder to:

- Compare businesses in the same industry

- Calculate taxes properly

- Track performance over time

Real-Life Example

Imagine a construction company that signs a $100,000 contract to build a house. The project will take six months.

Under accrual accounting, the company can recognize a portion of the revenue each month as the work is completed, even if the customer only pays at the end.

This way, income and effort are matched, and the company’s books reflect ongoing performance, not just cash movements.

Final Thoughts

Accrual accounting is one of the most important tools in business finance. It records transactions when they actually happen, not just when money is exchanged – giving a full and fair view of financial performance.

While it may be more complex than cash accounting, it allows businesses to plan better, report more accurately, and grow with confidence.

Whether you run a small business or manage finances in a large company, understanding accrual accounting helps you make smarter decisions and stay in control of your operations.