When a business sells products or services to a customer and allows them to pay later, the amount owed becomes an account receivable. It’s a promise from the customer to pay the business within a certain time, usually 30, 60, or 90 days.

Understanding accounts receivable is essential for managing cash flow, planning expenses, and making smart financial decisions. Let’s break down this concept in a simple way, explore how it works, and why it plays such a vital role in a company’s finances.

What Are Accounts Receivable?

Accounts Receivable (AR) is the money that a business is entitled to receive from customers after delivering goods or services on credit. It is listed on the balance sheet as a current asset, which means it’s expected to be converted into cash within a year.

In short, its money owed to the business.

Here’s a simple example:

If a company sells $5,000 worth of goods to a customer and gives them 30 days to pay, that $5,000 becomes an account receivable until the payment is made.

Why Is Accounts Receivable Important?

1. Supports Cash Flow

Although sales are recorded immediately, the cash isn’t received until customers pay. Managing accounts receivable helps businesses make sure they have enough cash on hand to cover daily operations.

2. Shows Financial Health

A growing amount in accounts receivable could be a sign of increased sales, but if payments are delayed, it could lead to cash flow problems. Regular monitoring helps businesses stay financially stable.

3. Builds Business Relationships

Offering credit helps build trust and loyalty with customers. It gives them flexibility to manage their own finances while encouraging repeat business.

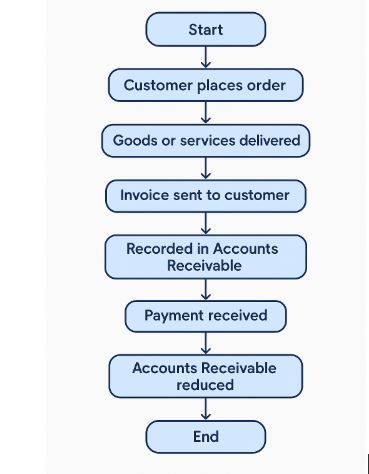

How Does It Work?

Here’s how the accounts receivable process typically works:

- A customer places an order.

- The business delivers the product or service.

- The business sends an invoice with a due date.

- The amount is recorded as an account receivable.

- When the customer pays, the receivable is cleared, and the business receives the cash.

Credit Terms and Due Dates

Most businesses allow customers to pay within a certain period, known as credit terms. These might be:

- Net 30 – Payment is due 30 days from the invoice date.

- Net 60 – Payment is due in 60 days.

- Or customized terms based on the client’s agreement.

Risks of Poor Accounts Receivable Management

If accounts receivable is not managed well, it can lead to serious financial problems. Some of the common risks include:

- Late Payments: Delayed customer payments can cause cash shortages.

- Bad Debts: Some customers may never pay, and the business may need to write off the debt.

- Disrupted Operations: Without steady cash flow, a business may struggle to pay employees, suppliers, or rent.

This is why strong receivable practices are essential for business success.

Best Practices for Managing Accounts Receivable

- Invoice Promptly

Send invoices as soon as goods or services are delivered. - Set Clear Payment Terms

Communicate expectations upfront – due dates, interest on late payments, and acceptable payment methods. - Use Accounting Software

Tools like Xero or QuickBooks help automate invoicing, reminders, and record-keeping. - Follow Up Regularly

Check for overdue invoices and send gentle reminders or phone calls. - Offer Discounts for Early Payments

Encourage customers to pay early by offering small incentives. - Screen Customers Before Extending Credit

Check the creditworthiness of new clients to avoid future collection issues.

How Accounts Receivable Appears in Accounting

In a business’s financial records, accounts receivable is listed under current assets on the balance sheet. When a sale is made on credit, revenue is recorded right away, and the same amount is added to accounts receivable.

Once payment is received, the cash account increases, and the receivable amount is reduced.

This flow of money from receivables to cash is a key part of the operating cycle of most businesses.

Accounts Receivable vs. Accounts Payable

It’s easy to mix up the two terms:

- Accounts Receivable is money owed to the business by customers.

- Accounts Payable is money the business owes to its suppliers.

Both are vital parts of working capital and need to be carefully monitored to maintain healthy finances.

Tracking Receivables Over Time

Businesses often use Aging Reports to track how long each receivable has been outstanding. This report groups invoices by how old they are – current, 30 days overdue, 60 days, and so on.

It helps the business see which invoices are close to or past their due date and take action accordingly.

Why Lenders and Investors Care About Receivables

Banks, lenders, and investors often look at a company’s accounts receivable to assess its financial reliability. If too much money is tied up in unpaid invoices, it can raise concerns about the company’s liquidity and collection practices.

A business with strong receivables management is more likely to secure funding or investment.

Final Thoughts

Accounts Receivable may seem like a simple concept, but it plays a major role in keeping a business running smoothly. It bridges the gap between delivering a product or service and actually getting paid.

By managing receivables effectively – setting clear terms, following up on invoices, and using automation – businesses can improve cash flow, reduce risk, and maintain strong relationships with their customers.