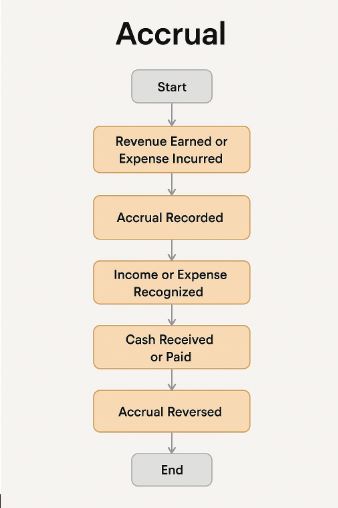

In accounting, the word “accrual” means recognizing revenue and expenses when they happen, not when the cash is actually received or paid. This concept is one of the foundations of modern financial accounting.

Accrual helps businesses get a clearer picture of their financial position by matching income and expenses to the time period in which they occur. Let’s explore what “accrual” means, how it works, and why it matters.

What Is Accrual?

In simple terms, an accrual is an entry made in the books when income is earned, or an expense is incurred- before any money changes hands.

For example:

- If a business delivers a service in April but gets paid in May, it still records the income in April.

- If it receives goods in March and agrees to pay in April, it records the expense in March.

This system ensures the business reports the true financial results of each period, regardless of cash flow.

Why Is Accrual Important?

1. Reflects Real-Time Business Activity

Accrual allows businesses to track what they’ve earned and what they owe, right when it happens, so financial statements show the actual business performance.

2. Matches Revenue and Expenses

A key benefit of accrual accounting is that it matches income with related expenses. This gives a more accurate idea of profits for each period.

3. Improves Financial Planning

By recognizing obligations and earnings early, businesses can plan ahead, forecast budgets, and make better financial decisions.

Accrual in Practice: Examples

Accrued Revenue

This is income that a business has earned but not yet received.

Example: A consultancy delivers a service in June, but the client pays in July. The revenue is accrued in June.

Accrued Expenses

These are expenses a business has incurred but hasn’t paid yet.

Example: Employees work in March and get paid in April. The wages are accrued in March.

Types of Accruals

There are two main categories:

- Accrued Revenue – Money earned but not yet received

- Accrued Expenses – Costs incurred but not yet paid

These are often recorded at the end of a financial period (e.g., month-end or year-end) so that the accounts show accurate figures.

How Accrual Differs from Cash Accounting

Accrual is different from cash accounting, where revenue and expenses are only recorded when the money is received or paid.

In cash accounting:

- If you deliver a service in April but get paid in May, you record it in May.

- With accrual, you record it in April.

Because of this difference, accrual accounting gives a completer and more accurate picture of a business’s performance.

Where Accruals Appear in the Financials

In a business’s books:

- Accrued revenue is recorded as an asset (accounts receivable).

- Accrued expenses are recorded as liabilities (accounts payable or accrued liabilities).

When the cash is finally received or paid, these entries are cleared.

Benefits of Using Accrual Accounting

- More accurate financial reporting

- Matches income to the correct period

- Helps investors, lenders, and stakeholders understand performance

- Better forecasting and decision-making

- Complies with standard accounting rules like GAAP and IFRS

Challenges of Accrual Accounting

- More complex than cash-based systems

- Requires careful tracking of transactions

- May show profits even when cash is tight

- Needs more accounting oversight and software

Because of these challenges, businesses often use accounting software or hire professionals to manage accrual entries correctly.

Who Should Use Accrual Accounting?

Accrual accounting is generally used by:

- Medium to large businesses

- Companies with inventory

- Businesses offering credit to customers

- Entities that require audited financial statements

Small businesses may choose cash accounting for simplicity, but as they grow, switching to accrual becomes necessary.

The Role of Accrual in Business Success

Accruals may seem like a technical detail, but they play a major role in:

- Understanding actual earnings

- Paying the right amount of tax at the right time

- Reporting accurate financial statements

- Managing long-term projects, contracts, and payments

In fact, without accruals, a company could look highly profitable in one month and loss-making in another, just because of when the cash moves.

Example Scenario: Monthly Subscription Business

Let’s say your business offers a monthly subscription. You bill customers on the 1st of each month for services you’ll deliver during the month.

Under accrual accounting:

- You record the revenue throughout the month as you deliver the service.

- Even if the customer pays upfront, the income is recognized over time.

This keeps your earnings aligned with your service delivery and avoids showing a large one-time spike in revenue.

Final Thoughts

Accrual is not just an accounting rule, it’s a smart way to understand how your business is really doing. It allows you to track your earnings and obligations in real time, plan ahead, and stay financially sound.

Whether you’re a startup or a well-established business, understanding and using accrual concepts gives you a clear edge in financial reporting and decision-making.