Charitable trusts play a vital role in society. These organizations operate with a mission to support public welfare, whether by advancing education, promoting health, or providing social services. However, since they rely on public or donor funds, it is essential to ensure that their financial activities are accountable, transparent, and lawful.

This is where the audit of a charitable trust comes in. An audit is more than a legal obligation; it is a process that confirms the trust’s financial integrity and operational compliance. In this article, we’ll explore what this audit entails, when it is required, and how it can be carried out effectively.

What is the Audit of a Charitable Trust?

The audit of a charitable trust is the formal and independent review of the trust’s financial statements, records, and internal systems. This audit is usually conducted by a qualified auditor who evaluates how the trust earns, spends, and records its funds. It also checks whether the trust is fulfilling legal requirements and operating within the scope of its registered purpose.

The aim of the audit is to give trustees, donors, and regulators confidence that the trust is using funds appropriately and managing risks effectively. It also helps identify areas for improvement and provides recommendations for better financial practices.

Why the Audit Matters for Charitable Trusts

Auditing a charitable trust supports three core goals: accountability, transparency, and trust. It allows the trustees to show that they are responsibly handling public funds. This is especially important because charitable trusts are not owned by individuals. The funds belong to the community, and trustees act as caretakers.

Secondly, the audit helps to maintain a good standing with regulators. In many jurisdictions, audited financial statements must be submitted to the charities register or other oversight bodies. Failure to comply can lead to deregistration or penalties.

Finally, an audit reassures donors and partners. It shows that the trust is not just promising to do good—it is also managing its finances with discipline and honesty.

When is an Audit Legally Required?

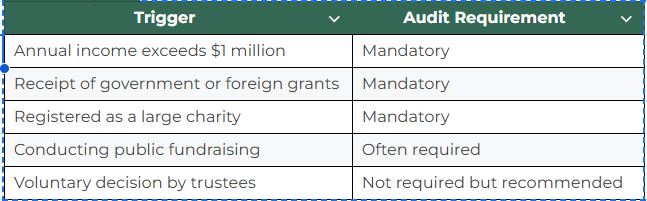

Not every charitable trust is required to undergo an audit. The requirement often depends on factors like annual income, public fundraising, or the amount of government funding received. However, even when not legally required, an audit can still offer reputational and operational benefits.

Here is a table outlining common triggers for mandatory audits:

Always check local regulations. For example, in New Zealand, the Charities Act requires large charities (by expenditure) to have audited financials, while smaller ones may opt for a review or compilation.

Documents Needed for the Audit

Before beginning the audit of a charitable trust, it is important to gather all key financial and operational documents. These help the auditor understand the trust’s transactions and verify their accuracy.

Typical documentation includes:

- Annual financial statements

- Bank statements and reconciliations

- Donation and grant registers

- Supporting invoices and receipts

- Payroll records (if applicable)

- Trust deeds and policies

- Minutes from trustee meetings

Providing these documents in an organized and timely manner makes the audit more efficient. It also reduces the risk of delays or incomplete findings.

Step-by-Step Process of the Audit of a Charitable Trust

The audit process is systematic and detailed. It involves planning, testing, reporting, and follow-up. Below is an expanded explanation of each step in the process.

1. Auditor Appointment

The process begins when the trustees appoint an external, independent auditor. The chosen auditor must be qualified and experienced in auditing not-for-profits. This appointment should be documented through a board resolution. Often, the trust signs an engagement letter with the auditor, which outlines the objectives, scope, and fees of the audit.

2. Planning the Audit

Next, the auditor gathers background knowledge about the trust. This includes its activities, sources of income, and any unique risk areas. The auditor may request preliminary information to design their audit plan. During this stage, the auditor also sets timelines, defines materiality levels, and communicates audit procedures with the trustees.

3. Internal Control Review

A key part of the audit is examining how well the trust’s internal controls work. These include checks like who authorizes expenses, how receipts are recorded, and whether segregation of duties exists. Weak internal controls can lead to errors or misuse of funds. The auditor evaluates whether the trust has proper financial oversight and risk management processes in place.

4. Substantive Testing

Substantive testing involves examining financial transactions to confirm accuracy. The auditor selects samples of income and expenses, matches them with source documents, and verifies their classification. For example, if a donation of $10,000 is recorded, the auditor checks bank entries and donor receipts to confirm the amount and timing. They may also review funding agreements to ensure funds were used for the intended purpose.

5. Compliance Assessment

The auditor checks whether the trust has met legal and regulatory obligations. This includes filing returns with tax authorities, renewing charitable registrations, and fulfilling grant conditions. If the trust received restricted donations or government grants, the auditor ensures that funds were spent according to those restrictions. Any non-compliance issues are noted in the audit findings.

6. Audit Report Preparation

Once testing is complete, the auditor prepares the audit report. This report provides an opinion on whether the financial statements give a true and fair view of the trust’s financial position. A clean report is called an “unqualified opinion.” If issues are found—such as missing records or misstatements—the report may be “qualified” or include additional comments. The trustees review the report and address any recommendations.

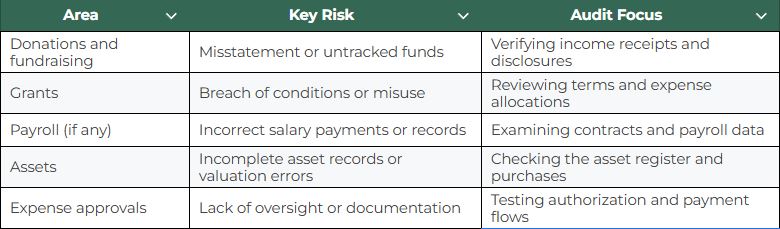

Common Focus Areas in Charitable Trust Audits

Some parts of a charitable trust’s finances are more likely to be scrutinized due to their complexity or risk of misuse. The auditor pays special attention to these areas during their work.

Addressing these areas with good documentation helps the trust pass audits smoothly.

Trustee Roles and Responsibilities in the Audit

Trustees are ultimately responsible for ensuring the audit process goes smoothly. They must ensure that all records are kept up-to-date, that proper controls are in place, and that the audit findings are taken seriously. They are also expected to meet all deadlines and respond to auditor queries in a timely manner.

Before the audit, trustees should review financial policies and perform internal checks. During the audit, they should be transparent, cooperative, and proactive. After the audit, trustees should review the findings, discuss any weaknesses, and oversee the implementation of auditor recommendations.

How Charitable Trusts Can Prepare for a Smooth Audit

Being prepared can make the audit easier and less stressful. Here are some key actions that charitable trusts can take:

- Maintain accurate and complete financial records throughout the year. Monthly reconciliation of bank accounts, consistent filing of receipts, and regular updates to the asset register all make a big difference.

- Use a standard chart of accounts so that similar transactions are always classified in the same way. This helps auditors analyze income and expenses more effectively.

- Ensure donor and grant documentation is organized and accessible. If a grant has special reporting conditions, these must be monitored closely and explained during the audit.

- Train staff and volunteers on financial policies. Good training ensures that everyone involved in managing funds understands their roles and responsibilities.

- Review the previous audit report and ensure that past recommendations have been implemented. This shows growth and commitment to best practices.

Conclusion

The audit of a charitable trust is a structured, formal process that reinforces transparency and accountability. It helps trustees understand the financial health of their trust, confirms that funds are being used correctly, and ensures that the trust meets legal and donor obligations. For donors, regulators, and the public, the audit provides reassurance that the trust is working honestly and efficiently toward its mission.

By following a clear audit process, preparing necessary documents, and supporting the auditor’s work, trustees can make the audit a valuable tool for improvement. Far from being a burden, a well-managed audit is a sign of good governance and long-term success for any charitable trust.

Frequently Asked Questions (FAQs)

1. Is an audit of a charitable trust always legally required?

No, an audit of a charitable trust is not always mandatory. Legal requirements vary based on the size of the trust, annual income, and the type of funding received. For instance, in New Zealand, only large trusts with operating expenses over NZD 1 million must undergo a full audit. Smaller trusts may only need a financial review. However, even when not legally required, a voluntary audit can improve credibility with donors and demonstrate a strong commitment to financial transparency.

2. How long does an audit of a charitable trust usually take?

The timeline for an audit of a charitable trust depends on factors like the size of the trust, quality of records, and complexity of transactions. A well-prepared small trust may take two to four weeks to complete the audit process. Larger trusts with multiple funding sources may require more time. Early planning, document readiness, and cooperation between trustees and the auditor are key to keeping the process on schedule. Delays often occur when financial records are incomplete or when issues arise during testing.

3. What happens if the audit identifies problems or irregularities?

If the audit identifies financial misstatements, poor internal controls, or regulatory breaches, these will be documented in the audit report. Depending on the severity, the auditor may issue a qualified or adverse opinion. Trustees are expected to take corrective actions, such as revising procedures, enhancing oversight, or correcting records. In some cases, issues must be disclosed to regulators or funding bodies. However, finding problems is not necessarily a sign of failure. Acting on audit recommendations helps the trust strengthen its financial systems and maintain accountability.