When a business sells products or services on credit, it expects to be paid at a later date. But how often does the business actually collect those payments? That’s where the Accounts Receivable Turnover Ratio comes in. This financial ratio helps companies measure how quickly they collect money from their customers. It’s an important tool that reflects how efficient a business is in managing its credit and cash flow. Let’s explore what this ratio means, how it’s calculated, and why it matters for any business offering credit sales.

What Are the Accounts Receivable Turnover Ratio?

The Accounts Receivable Turnover Ratio shows how many times a business collects its average accounts receivable during a specific time period, usually a year. In simple words, it tells you how quickly a business gets paid by its customers.

If the number is high, it means the business collects money quickly and doesn’t have to wait long. A low number may suggest that customers are taking too long to pay, or that the company is struggling to collect its dues.

Why Is It Important?

1. Improves Cash Flow Visibility

Cash flow is the lifeline of any business. Knowing how fast customers pay helps businesses plan their expenses and avoid cash shortages.

2. Reveals Credit Effectiveness

The ratio shows how well a business is managing its credit policy. If customers are taking too long to pay, it could be a sign that the business is too lenient with credit or not following up on overdue invoices.

3. Supports Financial Decision-Making

This ratio is often used by lenders, investors, and internal teams to assess a company’s financial health. It tells them how reliable the company is at collecting money it’s owed.

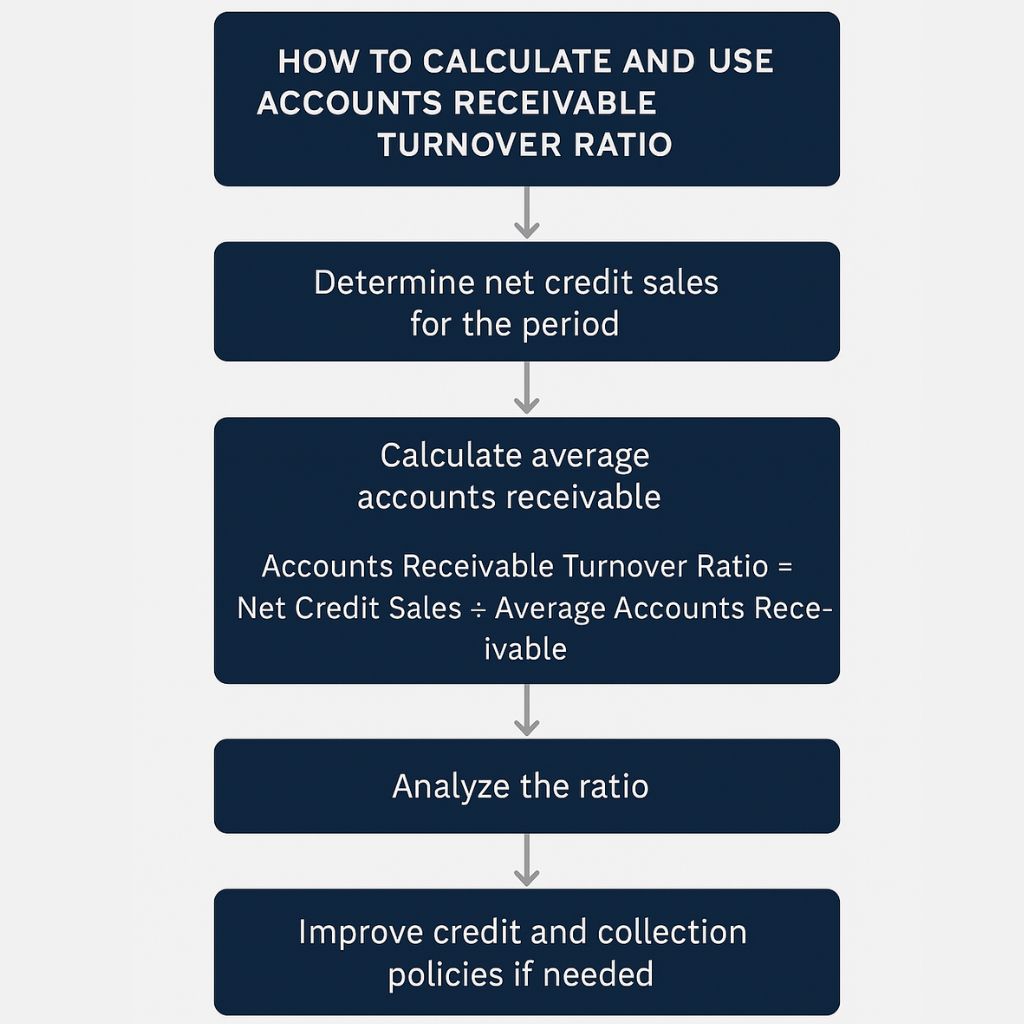

What Does the Ratio Look Like?

The formula to calculate it is:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

- Net Credit Sales: Sales made on credit, not including cash sales.

- Average Accounts Receivable: The average amount owed by customers during the period (usually the beginning and ending balance added together and divided by two).

Example (in words)

Let’s say a company made $500,000 in credit sales during the year. At the start of the year, customers owed $50,000, and by the end of the year, they owed $70,000.

First, find the average accounts receivable:

($50,000 + $70,000) ÷ 2 = $60,000

Then, calculate the turnover ratio:

$500,000 ÷ $60,000 = 8.33

This means the company collected its average receivables 8.33 times during the year.

What’s a “Good” Turnover Ratio?

There’s no one-size-fits-all answer. A good turnover ratio depends on the industry, the type of customers, and the credit terms offered. However:

- A high turnover usually means customers are paying quickly.

- A low turnover may signal delays in collection, potential bad debts, or poor credit control.

The key is consistency. Businesses should monitor their ratio over time to spot trends and take action if needed.

Why Might the Ratio Be Low?

A low accounts receivable turnover ratio could happen if:

- Customers are taking too long to pay.

- The business has extended long payment terms.

- There are many overdue or uncollectible invoices.

- The credit policy is too relaxed.

In such cases, the business might need to review its credit approval process, follow up more frequently, or use automated reminders.

How to Improve the Turnover Ratio

- Send Invoices Promptly

The sooner invoices go out, the sooner payments can come in. - Follow Up on Payments

Use polite reminders and keep regular contact with customers. - Offer Early Payment Discounts

Encourage quicker payments by offering small incentives. - Tighten Credit Terms

Review and adjust payment timelines and credit limits for high-risk clients. - Use Accounting Software

Tools like Xero or QuickBooks can automate invoicing and aging reports, saving time and reducing delays.

How It Helps in Financial Planning

The accounts receivable turnover ratio doesn’t just help with collections; it also supports broader financial planning.

For example:

- Budgeting: Knowing how fast money comes in helps plan future spending.

- Loan Applications: Lenders may review this ratio to decide if your business is creditworthy.

- Business Valuation: Investors and buyers use it to assess the efficiency and reliability of the company.

Accounts Receivable Turnover vs. Aging

While both relate to receivables, they serve different purposes:

- The turnover ratio shows how many times receivables are collected in a period.

- Aging reports show how long each invoice has been unpaid.

Used together, they provide a full picture of receivables performance – both the speed and the details.

Final Thoughts

The Accounts Receivable Turnover Ratio is a key performance indicator for any business offering credit sales. It shows how effectively the company turns credit into cash and keeps its cash flow healthy. By tracking this ratio regularly, companies can spot collection issues early, improve their credit policies, and make smarter business decisions. Whether you’re a small business owner, a finance manager, or an investor, this ratio offers a simple but powerful insight into a company’s financial efficiency.