Every business, no matter how big or small, buys goods and services to keep operations running. But these items are not always paid for immediately. In many cases, companies receive the goods first and pay later. The amount they owe during this time is called Accounts Payable.

Let’s take a closer look at what accounts payable means, how it works, and why it’s an essential part of a company’s financial system.

What are Accounts Payable?

Accounts Payable (AP) is the amount of money a company owes to its suppliers for goods or services that have been received but not yet paid for.

For example, imagine a business orders office supplies. The supplier delivers the products and sends an invoice but gives the business 30 days to pay. During those 30 days, the amount owed is recorded as accounts payable on the business’s books.

This amount is considered a liability because it’s money the business must pay in the near future.

How Does It Work?

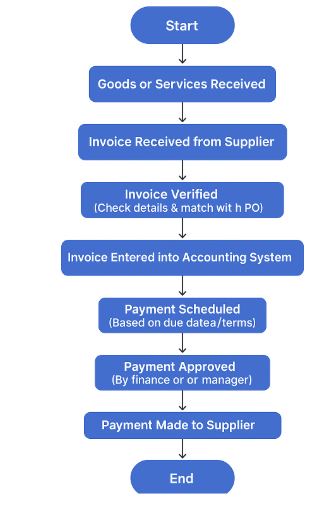

Accounts payable comes into play every time a business receives an invoice for products or services it has already received. Here’s a basic process:

- Purchase Made: The business orders items or services from a supplier.

- Goods or Services Delivered: The supplier delivers what was ordered.

- Invoice Received: The supplier sends an invoice with payment terms (for example, pay within 30 days).

- Payment Pending: Until the business pays the invoice, the amount is listed under accounts payable.

- Payment Made: Once the payment is completed, the accounts payable balance is reduced.

This system helps companies manage their short-term obligations while keeping their operations running.

Where It Appears in Financial Statements?

This financial term is listed on the balance sheet under the section called current liabilities.

The reason it’s called a current liability is that it usually needs to be paid within a short time, typically 30 to 90 days. This is different from long-term liabilities like loans that may take years to repay.

By looking at a company’s accounts payable balance, you can understand how much it owes in the short term.

Why Is Accounts Payable Important?

Accounts payable is more than just a list of unpaid bills. It’s a vital part of a company’s financial system that affects cash flow, vendor relationships, and overall financial health.

1. Keeps Track of Outstanding Bills

Properly managing accounts payable ensures that no invoices are forgotten or missed. This prevents delays, penalties, and double payments.

2. Improves Cash Flow

Holding onto cash a little longer, by using the full payment period, can help a business use its resources more wisely. This approach gives companies more flexibility in managing their daily operations.

3. Builds Trust with Suppliers

Paying suppliers on time creates a strong, reliable relationship. Suppliers are more likely to offer better payment terms, discounts, or fast service when they know they’ll be paid on time.

4. Supports Financial Planning

When accounts payable is tracked accurately, business owners get a clear view of their short-term financial obligations. This helps with budgeting and planning for the future.

Key Terms You Should Know

Understanding a few related terms can make accounts payable easier to manage:

- Invoice: A document sent by the supplier listing what’s owed.

- Due Date: The last date payment should be made.

- Net 30/Net 60: Common terms indicating payment is due in 30 or 60 days.

- Vendor: The company or person supplying the goods or services.

- Liability: A financial obligation or debt.

Difference Between Accounts Payable and Accounts Receivable

People often confuse accounts payable and accounts receivable, but they are opposites.

- Accounts Payable is money the business owes to others.

- Accounts Receivable is money others owe to the business.

In short:

- Payable = You pay

- Receivable = You receive

Both are important, and together they give a clear picture of a company’s financial position.

How to Manage Accounts Payable Effectively

Good accounts payable management keeps a company financially healthy. Here are some ways to do it:

1. Use Accounting Software

Modern accounting tools like Xero or QuickBooks, make it easier to track invoices, due dates, and payment history. They reduce errors and save time.

2. Set Up a Clear Process

Have a simple step-by-step process for receiving invoices, checking them, approving them, and making payments. This helps avoid confusion and ensures nothing is missed.

3. Schedule Payments Wisely

Pay close to the due date to keep your cash in hand longer, but never late. If early payment discounts are available, take them if it makes financial sense.

4. Communicate with Suppliers

If there’s an issue with an invoice or delivery, speak with the supplier early. Good communication helps avoid misunderstandings and keeps relationships positive.

5. Keep Records Organized

Store all invoices and payment records properly, whether digitally or physically. This is important for audits, tax filing, and business reviews.

What Happens When AP Is Mismanaged?

Poor management of AP can lead to several issues:

- Missed payments may result in late fees or legal problems.

- Damaged supplier relationships can affect future business deals.

- Cash flow issues can arise when too many payments are due at once.

- Errors in financial reporting could lead to wrong decisions or trouble during audits.

That’s why even small businesses should take accounts payable seriously.

Who Handles Accounts Payable?

In small businesses, the owner or bookkeeper might manage accounts payable. In medium or large companies, a dedicated AP clerk or finance team usually handles it.

Their tasks often include:

- Entering invoices into the system

- Matching invoices to purchase orders and delivery notes

- Ensuring payments are made on time

- Communicating with vendors about any issues

Having the right person or team in charge ensures nothing slips through the cracks.

Final Thoughts

Accounts payable is a simple but powerful part of business accounting. It represents the money a company owes to others and how well it manages those obligations.

When handled well, it helps a business:

- Stay organized

- Maintain strong supplier relationships

- Keep cash flow under control

- Make better financial decisions

It’s not just about paying bills. It’s about managing commitments, planning ahead, and running a more efficient business.

By staying on top of accounts payable, companies set the foundation for long-term success.