Financial crime is a global problem, and governments are cracking down. Businesses must now show they have strong systems in place to prevent money laundering and terrorist financing. This is where the AML CFT audit report becomes crucial.

An AML CFT audit report is a formal document that reviews how well a business complies with Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) laws. It evaluates whether your policies, procedures, and controls are working—and where improvements are needed.

This blog will explain what an AML CFT audit report includes, how it’s prepared, and why it’s vital for regulated businesses. Whether you’re in finance, real estate, law, or accounting, understanding this report is key to staying compliant, avoiding penalties, and protecting your brand.

What Is an AML CFT Audit Report?

An AML CFT audit report is a written summary that results from an independent review of your AML/CFT compliance framework. It outlines how well your business is detecting and preventing financial crime, based on current regulations and best practices.

The report typically includes:

- A review of your AML/CFT policies and procedures

- Testing of systems like transaction monitoring and customer due diligence

- Identification of weaknesses or gaps in compliance

- Recommendations for improvement

- A risk rating based on the audit findings

This report is usually prepared by an external or internal auditor who is not involved in your AML operations. It provides leadership and regulators with a clear picture of your compliance status and what actions are needed.

Why AML CFT Audit Reports Are Important

An AML CFT audit report is more than just a compliance document—it protects your business from financial, legal, and reputational harm.

Here’s why it matters:

- Regulatory Expectation

Most financial regulators require regular AML/CFT audits. The report proves that your business is actively monitoring its own compliance.

- Risk Management

Audits highlight weak points in your systems so you can fix them before criminals exploit them. - Independent Review

An external or independent audit provides an unbiased view of how your systems work in real life—not just on paper.

- Regulator Readiness

In case of a regulatory inspection, having up-to-date AML CFT audit reports shows you’re proactive and responsible.

- Internal Oversight

Leaders can make informed decisions about budget, staffing, and technology based on audit findings.

In short, the audit report acts as both a shield and a spotlight—protecting your business while helping you grow stronger.

Key Elements of an AML CFT Audit Report

A strong AML CFT audit report follows a structured format. Here are the key parts typically included:

1. Executive Summary

A brief overview of the audit findings, key risks identified, and top recommendations. This section is written for senior management and regulators.

2. Scope and Objectives

Outlines what areas were audited (e.g., customer onboarding, transaction monitoring, training) and why the audit was conducted.

3. Methodology

Describes how the audit was carried out—document reviews, staff interviews, system walkthroughs, and testing of sample transactions.

4. Findings and Observations

Detailed results from each area audited. This includes both strengths and weaknesses, with specific examples.

5. Risk Ratings

Issues are usually rated by severity—high, medium, or low—so the business knows which problems to fix first.

6. Recommendations

Clear and actionable suggestions to improve compliance processes and controls.

7. Follow-Up Actions

Any previous audit findings that have not yet been addressed will be revisited here.

Each section helps build a clear, complete picture of your AML/CFT compliance status.

Common Findings in AML CFT Audit Reports

Here are some of the most common issues found in AML CFT audit reports:

1. Incomplete Risk Assessments

Some businesses don’t regularly update their AML/CFT risk assessments, or they miss key risk areas.

2. Weak Customer Due Diligence (CDD)

Missing identity documents, poor verification steps, or failure to update customer info over time.

3. Insufficient Transaction Monitoring

Monitoring systems may miss suspicious activity or generate too many false alerts.

4. Inadequate Staff Training

Employees might not understand red flags for money laundering or how to report them.

5. Delayed or Missing Suspicious Activity Reports (SARs)

Failure to file reports on time—or at all—can lead to regulatory penalties.

6. Lack of Independent Review

Some companies skip the audit entirely or assign it to someone with a conflict of interest.

Identifying and fixing these issues early can prevent costly fines or reputational damage later.

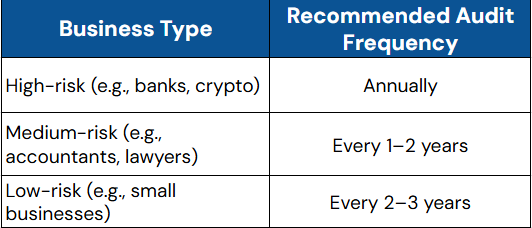

How Often Should AML CFT Audits Be Conducted?

How often you need an AML CFT audit depends on the size and risk level of your business.

However, even low-risk companies should do audits more frequently if they:

- Change ownership

- Expand into new markets

- Launch new products

- Experience suspicious activity

Ultimately, it’s better to audit more often than to fall behind. A missed audit can lead to higher risk exposure and regulatory trouble.

What Happens After the Audit?

After completing the audit, the final AML CFT audit report is shared with senior management. But the process doesn’t end there.

Step 1: Review the Report

Management and compliance officers should read the report in full and understand each finding.

Step 2: Assign Responsibilities

Assign team members to fix the identified issues and track their progress.

Step 3: Develop an Action Plan

Create a timeline for implementing recommendations. High-risk items should be addressed first.

Step 4: Monitor Progress

Follow up regularly to ensure that the improvements are made on time.

Step 5: Document Everything

Keep detailed records of the changes made. Regulators may ask for this during their own inspections.

An audit is only as useful as the action that follows it. Turning findings into real fixes is what improves compliance and reduces risk.

FAQ: AML CFT Audit Report

1. What is the difference between an AML audit and an AML CFT audit?

An AML audit focuses only on preventing money laundering. An AML CFT audit also includes the systems used to stop terrorist financing. Both share many of the same tools and processes, but CFT adds another layer of legal and operational requirements that must be addressed in the audit.

2. Who should prepare an AML CFT audit report?

An independent person or team should prepare the audit report. This can be an internal auditor not involved in day-to-day AML tasks or an external consultant with AML/CFT expertise. Independence ensures the findings are unbiased and reliable for both management and regulators.

3. Can I use the same report for multiple years?

No. Each AML CFT audit report must reflect the business’s current structure, risks, and compliance efforts. While templates and formats may remain the same, findings, recommendations, and assessments must be updated with each new audit cycle.

4. What happens if I ignore the audit report findings?

Ignoring the findings can lead to serious consequences—fines, legal penalties, or even losing your license. Regulators expect businesses to act on audit recommendations quickly. Failure to do so may be seen as negligence or non-compliance, especially if problems repeat in future inspections.

5. How do I prepare for an AML CFT audit?

Start by reviewing your internal AML/CFT policies and training your staff. Make sure you have complete records of due diligence, monitoring activities, and reports filed. A self-assessment or pre-audit checklist can also help highlight gaps before the audit begins.

Conclusion

An AML CFT audit report is a key part of staying compliant and protecting your business. It highlights where your systems are strong and where they need improvement. More importantly, it shows regulators, clients, and partners that you take financial crime prevention seriously.

By conducting regular, independent audits and acting on the results, you can build a stronger compliance framework and reduce your risk of penalties.

Would you like a sample audit report template or a checklist for your internal team? Let me know—I’d be happy to create one tailored to your business type.