Money laundering is a serious crime that affects businesses and the global economy. Governments around the world have created strong rules to stop it. Businesses that deal with money—like banks, accountants, real estate agents, and legal firms—must follow these rules. One of the most important tools to make sure these rules are being followed is an anti-money laundering audit, or AML audit.

An AML audit is a full review of your business’s systems, controls, and staff actions. It checks whether you are doing everything required to prevent and detect money laundering.

In this blog, we explain what an AML audit is, why it’s important, who needs it, what it includes, and how to prepare for one. We’ve written it in simple terms so anyone can understand—even if you’re new to compliance.

Let’s get started.

What Is an Anti-Money Laundering Audit?

An anti-money laundering audit is a formal check of how well your business follows AML laws. It is done by someone who understands AML regulations and can identify weak areas in your program.

The goal of an AML audit is to:

- Make sure your AML policies are correct

- See if your team is following those policies

- Check if your systems can spot risky activities

- Find areas where you can improve

Think of it like a health check—but for your compliance system. The audit gives you a full picture of your current setup and helps you find and fix problems before regulators or criminals do.

In most countries, an AML audit is a legal requirement. Even if it’s not, doing one regularly shows that you’re serious about protecting your business from financial crime.

Why an AML Audit Is Important

There are many reasons why an anti-money laundering audit is important—some legal, some practical.

Here’s why your business should take AML audits seriously:

- Regulatory requirement: In countries like New Zealand, Australia, the UK, and the US, AML audits are either required by law or strongly recommended.

- Risk prevention: Audits help spot gaps before money launderers or fraudsters can exploit them.

- Build trust: Customers, banks, and regulators trust businesses that take compliance seriously.

- Avoid penalties: If you’re found non-compliant during a regulator’s inspection, fines can be large—and reputational damage even worse.

- Improved processes: Regular audits lead to better systems, clearer policies, and stronger staff performance.

An AML audit is not just about following rules. It’s about staying safe, smart, and professional in a risky world.

What Does an AML Audit Cover?

An AML audit is wide-ranging. It doesn’t just look at your documents—it looks at how your business actually works.

Here’s what an auditor usually reviews during an AML audit:

1. Risk Assessment

Are you aware of the specific money laundering risks in your industry and business? Is your risk profile documented and updated?

2. AML Program / Policies

Do you have written AML procedures? Are they current and in line with legal requirements?

3. Customer Due Diligence (CDD)

Are you verifying your customers properly? Do you apply extra checks for high-risk customers?

4. Ongoing Monitoring

Do you regularly review client activities for suspicious patterns?

5. Suspicious Activity Reporting (SAR)

Do you know how to report unusual activity to the authorities? Are reports being filed correctly?

6. Training

Have all staff members received AML training? Do they understand their roles?

7. Record Keeping

Are you storing the right documents, and for the right amount of time?

8. Governance and Oversight

Is there a clear person responsible for AML in your business? Are they doing regular reviews?

The audit will usually end with a report that shows what you’re doing well—and what you need to improve.

Who Needs an AML Audit?

AML audits are required for businesses that handle financial transactions or deal with customer funds. These businesses are often called reporting entities or regulated entities.

Here are some examples:

- Banks and financial institutions

- Accounting firms

- Law firms and notaries

- Real estate agents

- Trust and company service providers

- Cryptocurrency exchanges

- Money remitters and payment service providers

- Casinos and gambling operators

Even small businesses in these industries need to follow AML laws.

In New Zealand, the AML/CFT Act requires audits every two years. In Australia, the same applies under AUSTRAC. In the US, audits are required as part of a written compliance program under the Bank Secrecy Act (BSA). In the UK, the Financial Conduct Authority (FCA) enforces similar rules.

If you’re not sure whether your business needs one, it’s best to check with your regulator.

How Often Should You Do an AML Audit?

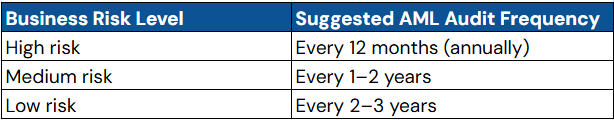

The frequency of AML audits depends on:

- Your local laws

- Your industry risk level

- Your business size and complexity

That said, here are some general guidelines:

Many countries require audits at least every two years, and some regulators may ask for more frequent audits if they think your risk is high.

Also, if your business changes—new services, new clients, or new risks—it’s smart to do an audit sooner.

Who Can Perform an AML Audit?

An AML audit must be carried out by a person or firm that is:

- Independent – They should not be part of your regular compliance team

- Qualified – They need to understand AML laws and how your business works

- Experienced – They should know what regulators expect

This could be an external compliance consultant, a specialist audit firm, or a dedicated AML auditor.

In some countries, internal staff can do the audit only if they are truly independent of the compliance function. However, most regulators prefer an external AML audit for full objectivity.

How to Prepare for an AML Audit

Here are simple steps to help you prepare for an AML audit:

1. Review your AML policy

Make sure it’s up to date and fits your current business model.

2. Update your risk assessment

Confirm that it reflects your current risks and customer types.

3. Organize your documents

Keep all customer files, CDD checks, training records, and reports ready.

4. Train your staff

Everyone should know the basics of AML and what their role is.

5. Test your processes

Check if your systems are working as expected—like alerts for unusual activity.

6. Speak with the auditor

Understand their process and give them what they need on time.

Being prepared makes the audit faster, smoother, and more useful.

What Happens After an AML Audit?

After the audit is complete, you’ll receive a formal audit report. This report includes:

- A summary of what the auditor reviewed

- A list of findings (good and bad)

- Areas where your program needs improvement

- Recommendations for fixing problems

You’ll be expected to take action on the report. This is called a remediation plan. It’s your responsibility to show that you’ve made the changes.

In some countries, you may also have to submit the audit report to your regulator.

Tip: Don’t wait to fix issues. Regulators prefer to see businesses that take action quickly.

FAQs About Anti-Money Laundering Audit

1. Is an AML audit mandatory for small businesses?

Yes, if your business is classified as a “reporting entity” under AML laws, then the audit is usually mandatory—regardless of your size. Small businesses are not exempt from anti-money laundering obligations. Regulators expect even small firms to have the right controls in place and to do regular audits. However, the scope of the audit may be lighter if your risk is low.

2. How long does an AML audit take?

The time needed depends on the size and complexity of your business. A small firm may take 2–3 days, while a larger or high-risk company could take 1–2 weeks. The audit includes document reviews, staff interviews, and testing of systems. After that, the auditor prepares the report, which might take another few days. In total, expect the whole process to take 1 to 3 weeks.

3. Can I do the AML audit myself?

No, you cannot audit your own AML program if you are part of the compliance team. The audit must be done by someone independent—this could be a third-party consultant or a staff member with no involvement in day-to-day AML operations. Doing it yourself may lead to bias, and regulators may reject the audit as invalid.

4. What if the AML audit finds problems?

That’s actually a good thing—it means the audit is working. The goal of an AML audit is to find and fix gaps before a regulator or criminal does. If the report shows weaknesses, you’ll need to create a remediation plan and take action. In most cases, regulators are more lenient if they see you’re actively working to improve. It’s better to fix it now than face penalties later.

5. How do I choose a good AML auditor?

Look for an AML auditor with strong experience in your industry, proper certifications, and a clear, structured approach to auditing. Ask for references or case studies. A good auditor should explain their process clearly, help you understand the results, and give useful recommendations—not just find problems. Also, check that they are truly independent and haven’t helped set up your AML system.

Final Thoughts

An anti-money laundering audit is not just a regulatory box to tick. It’s a smart and necessary step for any business that wants to stay safe, legal, and trusted.

AML audits help you:

- Catch weak points before they become major risks

- Build better systems and train better staff

- Stay ahead of compliance changes

- Avoid costly fines and investigations

Whether you’re a small firm or a large financial service, AML audits help protect what matters—your business, your clients, and your reputation.

Start early, prepare well, and treat the audit as an investment in your company’s future.