If your business is in a regulated sector like finance, real estate, or legal services, you probably know about AML (Anti-Money Laundering) requirements. But following AML laws isn’t enough—you also need to prove that you’re doing it right. That’s where an independent AML audit comes in.

An independent AML audit is a detailed review of your AML program, done by someone who isn’t involved in your day-to-day operations. This ensures that the audit is fair, honest, and unbiased.

Many countries—including New Zealand, Australia, the UK, and the US—require businesses to perform these audits regularly. Failing to complete one, or doing it poorly, can lead to fines, penalties, or loss of reputation.

In this blog, we’ll explain what an independent AML audit is, why it matters, what it includes, who needs one, and how to get ready for it—using simple language and practical advice.

What Is an Independent AML Audit?

An independent AML audit is a formal review of your company’s anti-money laundering controls, conducted by a person or firm not involved in managing or operating your AML program.

This makes the audit objective and reliable.

The purpose is to check whether your AML policies and procedures actually work, and if they meet all legal and industry requirements. The auditor looks at things like how you onboard clients, monitor transactions, report suspicious activity, and train your staff.

An independent audit is different from an internal review. While you might do internal reviews regularly, the independent AML audit gives regulators confidence that your controls are tested by someone with no conflict of interest.

Think of it like a health check—only for your compliance systems. It finds weak areas before they turn into serious problems.

Why an Independent AML Audit Is Important

An independent AML audit is not just a legal requirement—it’s a smart business decision.

Here’s why it matters:

- Unbiased view: An external auditor offers a fresh perspective and spots issues you might miss internally.

- Stronger compliance: Regular audits help keep your AML program in line with the latest rules and industry practices.

- Regulatory trust: Showing regulators that you take AML seriously can reduce scrutiny and build trust.

- Risk reduction: Audits identify risks early—helping prevent fines, fraud, and reputational damage.

- Staff accountability: When staff know their work will be checked, they are more likely to follow procedures properly.

Whether you’re a small accounting firm or a large financial service provider, an independent AML audit shows your commitment to doing the right thing.

What’s Included in an Independent AML Audit?

A proper independent AML audit follows a structured process. The auditor checks how your AML program works in real life—not just what’s written on paper.

Here’s what they usually look at:

- Risk assessment: How well have you identified and documented the money laundering risks your business faces?

- Customer due diligence (CDD): Are you verifying customer identities properly, including enhanced due diligence for high-risk clients?

- Transaction monitoring: Do you have systems to detect unusual or suspicious behavior?

- Suspicious activity reporting: Are your processes for reporting to the authorities timely and accurate?

- Record keeping: Are you maintaining required documents and logs for the right period?

- Staff training: Are employees regularly trained, and do they understand their AML responsibilities?

- Policy reviews: Are your AML policies updated regularly based on changes in law or business activity?

The auditor then reports what’s working and what needs fixing.

Who Needs an Independent AML Audit?

Any business covered by AML laws may need an independent AML audit. This includes:

- Financial institutions (banks, lenders, brokers)

- Accountants and auditors

- Real estate agents

- Law firms

- Trust and company service providers

- Crypto and digital asset platforms

- Money remitters and exchange businesses

- Casinos and gaming operators

In most cases, the requirement is based on your regulator’s rules. For example:

- In New Zealand, reporting entities under the AML/CFT Act must complete an independent audit every 2 years.

- In Australia, entities registered with AUSTRAC are expected to conduct independent reviews regularly, based on risk.

- In the US and UK, audits are often annual or based on the size and complexity of the business.

If unsure, it’s best to check with your regulator or seek professional advice.

How Often Should an Independent AML Audit Be Done?

There is no one-size-fits-all answer. The required frequency depends on your local AML laws and your business risk level.

However, the general standard is:

- Every 1 to 2 years for most regulated businesses

- Annually if your business deals with high-risk clients or large volumes

- More frequently if there have been compliance issues in the past

Remember: doing the audit regularly is about more than just following rules. It’s about staying ahead of risks.

Some businesses also conduct mini internal reviews between full audits to stay on track.

Tip: Schedule your audit well in advance. Don’t wait until the last minute before a regulator requests it.

What Makes an AML Audit Truly “Independent”?

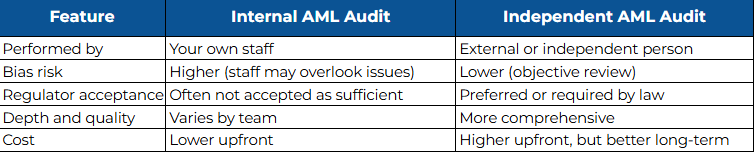

Before we show the table, let’s make this clear:

Just because someone works outside your company doesn’t mean their audit is fully independent. To be accepted by regulators, the auditor must have no involvement in your AML program.

That includes:

- No role in designing or managing your AML processes

- No conflict of interest with your business

- Proper qualifications and understanding of AML laws

Table: Key Differences – Internal vs Independent AML Audit

How to Prepare for an Independent AML Audit

Getting ready for an independent AML audit doesn’t have to be stressful. A little planning goes a long way.

Here are five simple steps:

- Review your AML policy – Make sure it reflects current laws and your business activity.

- Update your risk assessment – Be clear on how you identify and manage AML risks.

- Organise your records – Keep CDD documents, transaction logs, and training files in one place.

- Test your reporting process – Ensure your staff know how and when to file suspicious activity reports.

- Train your staff – Everyone should understand their AML duties and be ready to answer questions.

It also helps to speak with the auditor before the audit starts. They might give you a checklist to prepare more efficiently.

What Happens After the Audit?

Once your independent AML audit is complete, the auditor will:

- Give you a report – This includes findings, strengths, weaknesses, and recommendations.

- Ask for an action plan – You’ll need to fix any problems within a set timeline (usually 30 to 90 days).

- Follow up – In some cases, a follow-up review may be needed to confirm fixes.

The report may also need to be shown to your AML regulator if requested. That’s why it’s important to keep a clear record of what you did and when.

If the report highlights major problems, regulators may investigate further or take enforcement action.

FAQs About Independent AML Audit

1. What is the difference between a normal AML audit and an independent AML audit?

A regular AML audit might be done by your own team or someone familiar with your operations. An independent AML audit, on the other hand, must be done by someone not involved in your business. This ensures the findings are objective, and it meets the expectations of regulators. Independence is important because it removes the risk of bias or conflict of interest.

2. Who can conduct an independent AML audit?

An independent AML audit should be done by a qualified person or firm with experience in AML compliance and knowledge of your industry. This could include external consultants, AML specialists, or audit firms. They must not have helped you design your AML systems or manage your compliance in the past. They also need to follow the auditing guidelines set by your local laws.

3. How much does an independent AML audit cost?

The cost depends on the size of your business, how complex your operations are, and the experience of the auditor. A small business might spend a few thousand dollars, while large or high-risk firms may spend significantly more. While the cost may seem high, it’s often much less than the fines or losses that could come from a failed AML program. It’s an investment in safety and trust.

4. What happens if I don’t do an independent AML audit?

Not completing your required AML audit can lead to regulatory action, including fines, public warnings, or even suspension of your license. Regulators expect businesses to monitor themselves and show they’re actively managing AML risks. Skipping the audit sends the opposite message. It’s also risky for your reputation and could make it harder to work with banks or financial partners.

5. Can I use a checklist to do my own independent AML audit?

No, you can’t do an independent AML audit by yourself if you’re part of the business. However, you can use checklists to prepare for the audit or run internal reviews. These tools are great for spotting early issues. But to meet legal standards, the actual independent audit must be done by a qualified third party with no involvement in your AML system.

Final Thoughts

An independent AML audit is not just a box to tick—it’s a vital part of responsible business. It shows regulators, clients, and partners that your company takes compliance seriously and is ready to fight financial crime.

By choosing the right auditor and preparing well, the process can be smooth, valuable, and even improve your operations.

If your industry or country requires AML audits, don’t wait. Schedule yours early, fix gaps in advance, and treat it as a long-term investment in trust and transparency.