Money laundering is a serious issue worldwide. It allows criminals to hide illegal money and use it in the normal economy. To stop this, governments have strict rules known as AML (Anti-Money Laundering) regulations. Businesses must follow these rules, especially if they deal with money, finance, or real estate.

To check if companies are following the rules, they go through an AML audit.

An AML audit is a review of your internal systems and processes to see how well you prevent, detect, and report suspicious activities. These audits are not just a legal requirement—they also protect your business from risk, fines, and damage to your reputation.

In this blog, we’ll explain what an AML audit is, how it works, what it includes, and why it matters—whether you’re a small business or a large financial institution.

What Is an AML Audit?

An AML audit checks if your business is doing enough to stop money laundering. This includes looking at your policies, staff training, transaction monitoring, and reporting systems.

The audit can be done by internal staff (if they are independent) or by an outside expert. The goal is to make sure your AML program is strong, up to date, and working as required by the law.

It’s not just about ticking boxes. A proper AML audit looks at how your systems work in real life, whether your staff understand their responsibilities, and whether you can detect risky or suspicious behavior early.

Regulators in many countries, including New Zealand, Australia, the UK, and the US, require regular AML audits. If you fail to carry out an AML audit or fix issues, you could face big penalties—or even lose your license.

Why Is AML Auditing Important?

AML auditing is important because it helps your business stay safe, legal, and trustworthy. Here’s why:

- Legal compliance: If you are in a regulated industry, you must have an AML audit. Failing to do so can result in fines or business restrictions.

- Reputation protection: If you unknowingly allow money laundering through your business, it could harm your reputation—even if it was unintentional.

- Operational safety: An audit finds weak points in your systems so you can fix them before criminals take advantage.

- Staff accountability: AML audits test whether your staff are trained and following the right steps when they see suspicious activity.

- Improved controls: The recommendations from an audit help you build stronger systems for customer checks, monitoring, and reporting.

In short, AML audits help protect your business from legal risk, financial loss, and public damage.

What Does an AML Audit Include?

An AML audit usually includes several important checks. The auditor reviews documents, systems, and staff awareness. Here’s what they usually cover:

- Risk assessment: Does your business know which areas are most at risk of money laundering?

- Policies and procedures: Do you have written rules for identifying customers, monitoring transactions, and reporting issues?

- Customer Due Diligence (CDD): Are you verifying customers properly? Are high-risk clients being monitored closely?

- Transaction monitoring: Do you have systems to spot unusual or suspicious activity?

- Staff training: Are your employees trained to understand and follow AML laws?

- Record keeping: Are you keeping records as required by your local AML laws?

- Suspicious Activity Reporting (SAR): Are you filing reports with the proper authorities when needed?

The auditor will also check how often you review your AML program and whether past issues have been fixed.

Who Needs an AML Audit?

AML audits are usually required for any business in a regulated sector, especially:

- Banks and financial institutions

- Accountants and auditors

- Law firms (for trust accounts or real estate transactions)

- Real estate agencies

- Money remitters and currency exchange businesses

- Investment and insurance companies

- Gambling operators (casinos, betting shops)

In many countries, even small businesses in these industries must follow AML rules. If you’re unsure, it’s best to check with your local regulator.

Even if you’re not legally required, doing a voluntary AML audit shows that your business takes compliance seriously. It’s a good move if you plan to grow, attract investors, or apply for licensing.

How Often Should an AML Audit Be Done?

In most places, AML audits must be done at least once every two years. However, some regulators recommend or require annual audits—especially if:

- You’re in a high-risk industry

- You have many high-risk customers

- You’ve had issues with AML compliance before

- You’re growing fast and your operations are changing

Doing it more often helps keep your business up to date with new risks, staff changes, and law updates.

Some businesses also perform internal mini audits every 6 months to catch problems early before their official audit.

The best approach? Don’t just wait for the deadline—treat AML audits as part of your ongoing risk management.

Before and after the AML Audit: What to Expect

An AML audit follows a clear process. Here’s what usually happens before and after:

Before the audit:

- You gather documents like AML policies, risk assessments, training records, and reports.

- The auditor may send a checklist or pre-audit questionnaire.

- Staff should be informed and ready to answer questions.

During the audit:

- The auditor reviews your files and systems.

- They may interview staff.

- They check if you follow legal requirements and internal rules.

After the audit:

- You receive a written report showing what was done well and what needs improvement.

- You are expected to fix any issues within a set time (usually 3–6 months).

- Regulators may ask to see the report or your action plan.

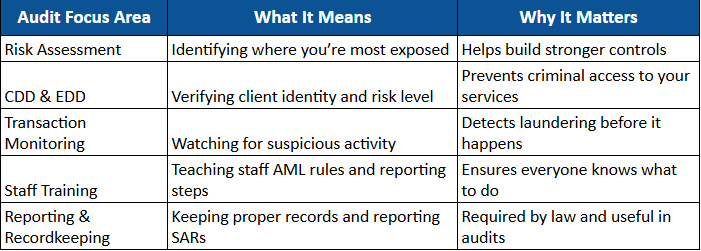

Table: Key Areas Covered in an AML Audit

Before we get into the table, let’s explain why it matters.

Knowing what the auditor will look for helps you prepare in advance and avoid last-minute stress. Here’s a summary of the main focus areas:

FAQs About AML Audits

1. What happens if I fail an AML audit?

Failing an AML audit can lead to serious consequences. Regulators may issue warnings, fines, or even revoke your license. You may also be asked to fix the problems within a short time. If you fail again, the penalties are usually much higher. A failed audit also damages your reputation with banks, partners, and clients.

2. Who can conduct an AML audit?

AML audits should be done by a qualified and independent person. This could be someone in your company (if they’re not involved in daily operations), or an external expert or consulting firm. The person must understand AML laws, your industry, and how to test compliance properly.

3. How can I prepare for my next AML audit?

Start by reviewing your current AML program. Make sure all policies are updated. Check that your staff are trained and that all required records are in place. You can also conduct a mock audit or use a checklist to find gaps. Fix issues before the real audit begins. This shows you’re proactive and responsible.

4. What should be included in an AML policy?

Your AML policy should include risk assessment, CDD/EDD procedures, transaction monitoring, staff training, reporting obligations, and recordkeeping practices. It should clearly explain who is responsible for what and how to handle suspicious activity. A strong policy is the first step in passing an AML audit.

5. Is an AML audit the same as an AML review?

Not exactly. An AML review is usually internal and may be lighter. An AML audit is more formal and detailed, often done by an independent person. Reviews are useful for quick checks, but audits are required to meet legal standards. Both are important for good compliance.

Final Thoughts

An AML audit is more than just a legal checkbox. It’s a smart way to protect your business, your customers, and your future. With the right preparation, these audits can be smooth, helpful, and even strengthen your company.

If your business falls under AML rules, don’t wait. Review your policies, train your staff, and schedule regular audits. A strong AML program is one of the best defenses you can build against risk and fraud.