Every business wants to grow. Whether it’s gaining more customers, launching new products, or expanding into new markets—growth is the goal. But to grow the right way, businesses need support behind the scenes. This is where audit, tax and consulting services come in.

These services do much more than just meet legal or financial requirements. They help businesses identify risks early, save money through tax planning, and make smarter decisions through expert advice.

In this blog, we’ll explore how these three services work together to support long-term business growth. We’ll look at practical benefits, examples, and key reasons why even small businesses should invest in audit, tax and consulting services.

The Link Between Business Growth and Professional Services

Business growth isn’t just about sales—it’s about building a strong and stable foundation. As your business grows, so do your risks, responsibilities, and decision-making needs. That’s where professional services become essential.

- Audit services ensure your financial data is accurate, which builds trust with banks, investors, and partners.

- Tax services help reduce your tax burden and keep you compliant with changing laws.

- Consulting services provide strategic advice so you can grow faster and smarter.

Together, these services reduce risk and increase confidence. Growth without structure can be dangerous, but growth backed by professional insights is sustainable.

Role of Audit in Supporting Growth

Audit services help businesses grow with confidence. When your financial reports are clear and accurate, it’s easier to make bold decisions. You can also show potential investors, lenders, or buyers that your business is healthy and well-managed.

As businesses expand, financial reporting becomes more complex. Auditors ensure that your reports meet accounting standards and help identify issues like errors, fraud risks, or cash flow problems early. This prevents small mistakes from becoming big problems.

Regular audits also improve your internal controls—systems that track spending, revenue, and compliance. As you grow, these systems need to be strong. An auditor’s recommendations can strengthen your foundation and keep you ready for new opportunities.

In short, audits don’t just find problems—they help build systems that support long-term success.

How Tax Services Enable Smarter Growth

Paying taxes is part of doing business—but smart tax planning can help you grow faster. Tax services help you reduce unnecessary costs, stay compliant with the law, and plan your finances better.

A tax expert can advise you on things like:

- When to buy new equipment to claim deductions

- How to structure your business to save on taxes

- What benefits to offer employees that are tax-friendly

As your business grows, your tax situation gets more complex. You may deal with multiple regions, employee benefits, GST or VAT rules, or new investments. A tax professional helps you navigate this complexity and avoid penalties.

Tax savings can be reinvested into your business—hiring more staff, upgrading tools, or launching new services. So, good tax advice is not just about compliance—it’s a smart growth strategy.

Consulting Services: The Growth Accelerator

Consultants help businesses make big decisions. Whether it’s entering a new market, reducing costs, or changing your technology, consulting services guide you with data, strategy, and experience.

Consultants bring outside knowledge. They study your business, spot areas of improvement, and offer actionable solutions. For growing businesses, this is gold.

Let’s say you want to expand into a new city. A consultant can help with market research, cost estimates, hiring plans, and operational setup. This reduces risk and speeds up progress.

Consulting also helps internally—by improving workflows, training leaders, and reviewing your finances. These improvements help you grow efficiently, without wasting time or money.

In short, consulting services give you expert support when it matters most—during key stages of growth.

Benefits of Using All Three Services Together

Using audit, tax and consulting services together creates a powerful support system. Each service complements the others and offers a well-rounded approach to managing growth.

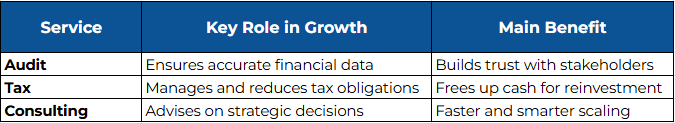

Before presenting the table, let’s explain:

For example, after a financial audit, your tax advisor can use the same accurate data for smarter tax planning. Then a consultant can use the updated numbers to plan future investments or expansion strategies. This teamwork saves time and boosts results.

Here’s a quick comparison to show how they support business growth:

Each service plays a unique role—but when used together, they keep your business strong, legal, and competitive.

A Real-World Scenario: From Local to National

Imagine a small bakery chain, SweetRise Ltd., operating in one city. After seeing steady profits, they decide to expand across the country.

- Audit services help them prove their current performance to investors and banks, making it easier to secure funding.

- Tax advisors restructure their business to take advantage of regional tax credits and avoid double-taxation as they expand.

- Consultants help them plan new store openings, hire the right staff, and streamline supply chains.

Thanks to using all three services, SweetRise expands without major issues. They avoid overspending, stay compliant, and grow with confidence.

This shows how audit, tax and consulting services work together to turn a local success into a national brand.

When Should Businesses Start Using These Services?

Many businesses wait too long to bring in professional help. But the best time to start is before things become too complex. Here’s a guide:

- Start with tax services early on—even freelancers can benefit.

- Add audit services when you’re applying for funding, growing fast, or need to improve your systems.

- Use consulting services when facing big decisions like expansion, cost-cutting, or restructuring.

Even if you can’t afford all services at once, begin with what matters most now—and build up as you grow. Waiting too long could cost you more later in missed opportunities or expensive mistakes.

Frequently Asked Questions (FAQs)

1. How do audit, tax and consulting services support business growth?

They reduce risk, improve decision-making, and keep your business compliant. Audits confirm the accuracy of your financials. Tax services help you save money legally. Consulting services guide your strategic moves. Together, they allow businesses to grow confidently and avoid costly mistakes.

2. Can small businesses afford these services?

Yes. Many firms offer scalable packages based on your business size and needs. For example, you might start with just tax services or a business consultation. Over time, as your needs grow, you can add audits or deeper consulting. Think of it as an investment that pays off through savings, support, and smarter decisions.

3. Are these services only needed during financial trouble?

No—these services are proactive, not just reactive. Waiting until something goes wrong can be risky and expensive. Using these services early helps you prevent problems, make better choices, and stay ahead of competitors. They’re useful during growth, not just during crisis.

4. How do I choose the right firm for these services?

Look for experience, clear pricing, and firms that offer all three services under one roof if possible. Ask for case studies, client references, and make sure they understand your industry. A good provider should feel like a business partner, not just a service provider.

5. What happens if I ignore these services?

You may face penalties, cash flow issues, or missed growth opportunities. Poor tax planning can lead to audits and fines. No audits may mean investors won’t trust your data. Lack of consulting can lead to poor decisions. These services protect your business from financial and strategic risks.

Final Thoughts

Growing a business is exciting—but it also brings new challenges. To grow well, you need more than just customers and marketing. You need systems, strategy, and support.

That’s where audit, tax and consulting services come in. They help you grow safely, legally, and profitably. From verifying your numbers to planning your taxes and shaping your strategy, these services give you a strong foundation for success.

Whether you’re just starting or scaling fast, don’t overlook these essential tools. They’re not just for large corporations—they’re for any business that wants to grow the smart way.