Audit, tax and advisory services are the three main pillars of professional financial services offered by accounting and consulting firms. These services help businesses meet legal requirements, make better decisions, and improve performance.

- Audit services focus on checking the accuracy of financial statements.

- Tax services help individuals and companies comply with tax laws while planning their tax payments in the best way possible.

- Advisory services offer expert advice on improving operations, reducing risks, and planning for the future.

These services are especially important for businesses, whether they are small, medium or large. They help in staying compliant, building trust with stakeholders, and making smart financial choices.

Let’s now look at each service one by one in detail.

Audit Services

Audit services are all about checking financial information. The goal is to ensure that a company’s financial records are correct and follow the law. An audit is usually done by an independent auditor or a team of auditors. They go through records, reports, and other documents to confirm that everything adds up and there are no big mistakes or fraud.

Audits give confidence to investors, banks, shareholders, and even the government. For example, if a company wants to get a loan from a bank, the bank will ask for audited financial statements. This helps the bank trust that the numbers are real.

There are different types of audits—internal audits, external audits, compliance audits, and forensic audits. Each type serves a different purpose, but all of them aim to make sure the numbers are honest and reliable.

In short, audits build trust and help businesses avoid legal or financial trouble.

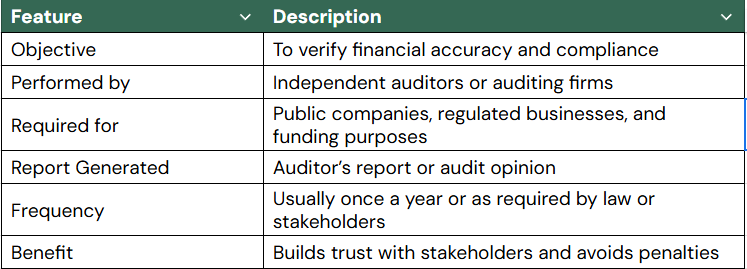

Key Features of Audit Services

Here’s a table showing the key features of audit services:

Audit services are not just about numbers. They are about transparency. A clean audit report tells people that a business is doing things the right way. That’s why audits are considered a sign of business maturity and responsibility.

Tax Services

Tax services help individuals and companies follow tax rules while also making sure they are not paying more tax than necessary. These services include preparing tax returns, managing tax payments, and offering advice on tax planning.

Every country has its own set of tax rules. These can be complex and change often. That’s why people turn to tax professionals to stay updated and avoid mistakes. A tax expert can help you find legal ways to reduce your tax bill, take advantage of available deductions, and file your taxes on time.

For businesses, tax services are even more critical. Companies need to manage payroll tax, corporate tax, goods and services tax (GST), and other types of taxes. Mistakes in taxes can lead to big fines and even legal trouble.

Tax professionals also help during audits by tax authorities. They act as a bridge between the business and the tax department.

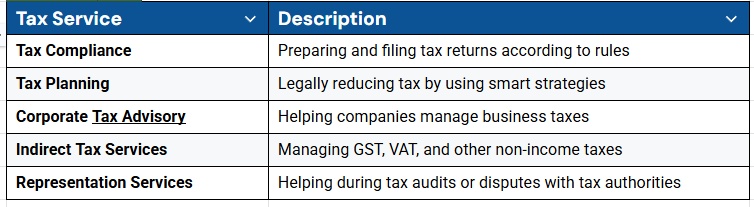

Types of Tax Services

Let’s look at a table that breaks down common types of tax services:

Tax services help you stay legal and smart with your money. Whether you’re an individual or a business, these services give peace of mind and save money in the long run.

Advisory Services

Advisory services are about giving professional advice to help businesses improve. This can include financial advice, risk management, technology solutions, and help with mergers or restructuring. These services are not just about fixing problems—they’re about spotting opportunities.

A business advisor studies how a company is performing and suggests ways to improve. This could be through better financial planning, more efficient operations, or digital transformation. Advisory services also help when a company wants to grow, enter new markets, or handle a crisis.

Think of advisory professionals as business doctors. They diagnose the situation, find out what’s wrong or what can be better, and suggest a solution. Sometimes they even stay on to help implement those changes.

Good advisory services can transform a business from surviving to thriving.

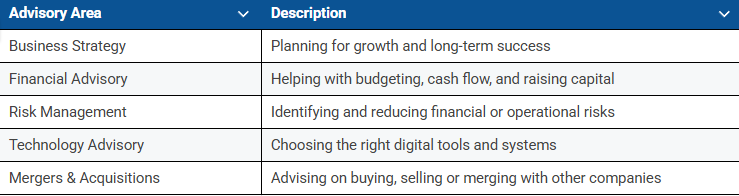

Common Areas of Advisory Services

Here’s a table of common advisory areas and what they focus on:

Advisory services bring an outside perspective, which is often what a business needs to see clearly. It’s like cleaning a foggy mirror—you finally see what’s actually going on.

Why Are Audit, Tax and Advisory Services Important?

Together, audit, tax, and advisory services create a full support system for businesses. Let’s look at why they matter:

- Compliance: These services help you follow laws and avoid penalties.

- Trust: Audits make your numbers trustworthy, especially for banks and investors.

- Savings: Smart tax planning means you save money without breaking any rules.

- Growth: Advisory services help your business grow in the right direction.

- Crisis Management: When things go wrong, these professionals help fix them.

In today’s fast-changing world, having experts on your side is not a luxury—it’s a must. With new regulations, changing markets, and financial pressures, businesses need to stay sharp. That’s what these services are for.

Example

Let’s say there’s a company called GreenTech Ltd. It’s a small business in the solar energy industry. Here’s how they use audit, tax and advisory services:

- Audit: Their annual financials are reviewed by an external auditor, giving confidence to their investors.

- Tax: A tax consultant helps them claim renewable energy tax credits, lowering their tax bill.

- Advisory: An advisory team helps them expand into a new country and find funding for their next project.

By using all three services, GreenTech grows safely, legally, and strategically.

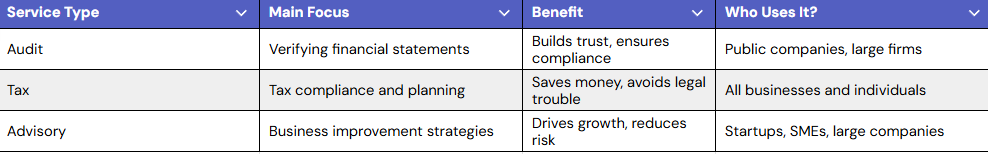

Audit, Tax and Advisory Services – Summary Table

Here’s a full comparison of the three services for a quick reference:

Each service plays a key role, but together, they create a strong foundation for long-term success.

Frequently Asked Questions (FAQs)

1. What’s the difference between audit, tax, and advisory services?

Audit services focus on checking the accuracy of a company’s financial information. Tax services deal with preparing tax returns and planning taxes in a legal way. Advisory services are about giving expert advice to improve business performance and solve problems. While each one is different, they are all connected and support a company’s overall success. Many firms offer all three services under one roof so clients can get full support in one place.

2. Why do businesses need audit services?

Businesses need audit services to build trust and follow the law. An audit confirms that a company’s financial statements are true and correct. This helps banks, investors, and partners trust the company. Some industries are legally required to have audits every year. Even if not required, many companies do audits to stay transparent and avoid future problems. It also helps management find areas of improvement in their internal systems.

3. How do tax services help save money?

Tax services help you plan ahead and use legal tax strategies to reduce your total tax bill. Experts look at your income, business structure, and transactions to find ways to reduce taxes through deductions, exemptions, or credits. They also make sure your returns are filed on time, which avoids penalties. By planning in advance, you can save money every year while staying 100% legal.

4. When should a company use advisory services?

A company should use advisory services when making big decisions—like expanding to new markets, buying another company, or changing its strategy. Advisors bring outside expertise that helps reduce risk and improve decision-making. They’re also helpful when a business is in trouble and needs help turning things around. Even successful companies use advisory services to stay ahead and grow faster.

5. Are these services only for big companies?

Not at all. While big companies often use all three services, small businesses and even individuals can benefit too. For example, a small business can get a tax expert to help save on taxes. A startup might need advisory help to raise funds. And any business that wants to grow or prepare for investors can benefit from an audit. These services scale to match the needs of the client.

Final Thoughts

Audit, tax and advisory services are like the three legs of a sturdy stool. Each one supports a different part of the business, and together, they create balance. Whether you’re running a small business or a big company, having the right experts in these areas can make all the difference. They help you stay legal, smart, and ready for the future.

It’s not just about avoiding mistakes—it’s about building something strong and lasting.