Auditing is a critical process for businesses of all sizes, ensuring compliance, financial accuracy, and operational efficiency. Choosing from the best auditing firms can be a challenging task, as businesses must evaluate expertise, industry knowledge, and regulatory compliance. In this guide, we explore the key factors to consider when selecting an auditing firm and why remote auditing solutions, like those provided by Aurora Financials, are revolutionizing the industry.

Understanding the Role of an Auditing Firm

An auditing firm provides financial verification and compliance services to businesses, ensuring that financial records are accurate and comply with industry regulations. These firms offer various services, including internal audits, external audits, tax audits, and risk assessments.

Auditing firms serve various industries, from small businesses to large corporations, by assessing financial health, identifying risks, and recommending best practices for regulatory adherence. Choosing one of the top auditing firms is crucial for companies seeking financial transparency and strategic growth.

Key Factors to Consider When Choosing an Auditing Firm

Selecting the right auditing firm requires careful evaluation of its services, expertise, and reputation. Below are key considerations:

1. Industry Experience

Look for an auditing firm with experience in your industry. Regulations and financial structures differ across sectors, so having auditors with relevant expertise ensures accurate financial assessments.

2. Compliance and Accreditation

Ensure the auditing firm follows established regulatory frameworks, such as:

- International Financial Reporting Standards (IFRS)

- Generally Accepted Accounting Principles (GAAP)

- Local taxation and financial reporting regulations

3. Reputation and Client Reviews

Research the firm’s reputation by checking client reviews, testimonials, and case studies. A firm with a proven track record will be more reliable.

4. Technology and Remote Capabilities

The best auditing firms leverage technology for remote audits, providing flexibility and efficiency. Aurora Financials specializes in remote auditing, allowing businesses across New Zealand to access top-tier audit services without location constraints.

5. Range of Services

A well-rounded auditing firm should offer:

- Internal audits (to assess internal processes and risk management)

- External audits (for financial compliance and investor confidence)

- Tax audits (ensuring tax compliance and efficiency)

- Risk management and advisory services

6. Cost-Effectiveness

Consider the firm’s pricing structure. While high-quality auditing services are an investment, ensure the fees align with the value provided.

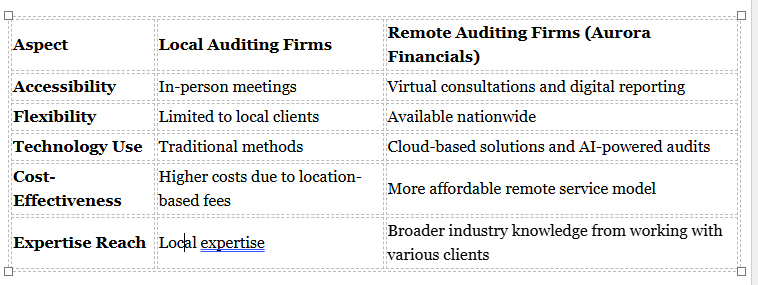

Comparing Local vs. Remote Auditing Firms

When searching for the top auditing firms near me, businesses often choose between local and remote firms. Here’s a comparison:

Why Choose Aurora Financials?

At Aurora Financials, we provide remote auditing and accounting services to businesses across New Zealand. Our expertise ensures compliance, risk management, and accurate financial reporting. We offer:

- Comprehensive auditing services tailored to your industry

- Advanced technology solutions for seamless remote audits

- Cost-effective services without compromising quality

- Expert guidance from seasoned professionals

Benefits of Working with Top Auditing Firms

Choosing from the top auditing firms offers several advantages:

1. Ensures Financial Accuracy

Professional auditors thoroughly assess financial statements, reducing errors and fraudulent activities.

2. Improves Compliance

Auditors help businesses adhere to financial regulations, avoiding penalties and legal complications.

3. Enhances Stakeholder Confidence

Accurate audits improve investor and stakeholder trust, contributing to business growth.

4. Identifies Financial Risks

Audit firms analyze financial data to detect risks and recommend corrective actions.

5. Facilitates Strategic Decision-Making

With accurate financial insights, businesses can make informed decisions to optimize operations and investments.

How to Find the Best Auditing Firms Near Me

If you’re searching for the best auditing firms near me, consider the following steps:

1. Conduct online research – Look for highly rated firms with positive client feedback.

2. Check professional accreditation – Ensure the firm meets financial compliance standards.

3. Request case studies – Ask for examples of past audit reports and success stories.

4. Compare pricing models – Assess whether the cost aligns with the quality of service.

5. Schedule consultations – Discuss audit requirements and service offerings before finalizing your choice.

Conclusion

Choosing from the top auditing firms is a critical decision for businesses seeking financial integrity and compliance. Whether you’re looking for auditing firms near me or considering remote services, it’s essential to prioritize expertise, technology, and reputation.

Aurora Financials offers reliable, remote auditing solutions that ensure transparency, efficiency, and compliance for businesses across New Zealand. Contact us today to discuss your audit requirements and enhance your financial processes.

FAQs

1. How can I find the best auditing firms near me?

Research online, check client reviews, verify accreditations, and schedule consultations to find the right firm for your business.

2. Why should I choose Aurora Financials for auditing?

Aurora Financials specializes in remote auditing, offering cost-effective, technology-driven audit solutions tailored to businesses across New Zealand.

3. Are remote auditing firms as effective as local firms?

Yes, remote auditing firms like Aurora Financials use advanced technology to provide accurate, efficient, and compliant audit solutions without geographical limitations.