An Audit Staff Accountant plays a crucial role in financial oversight, ensuring the accuracy, transparency, and compliance of financial records. Businesses rely on auditors to maintain financial integrity, prevent fraud, and adhere to regulatory standards. Whether working for a public accounting firm, a corporate finance department, or a government entity, an audit staff accountant is an essential part of the auditing process. This article explores the key responsibilities, skills, career path, and importance of audit staff accountants in today’s financial landscape.

What is an Audit Staff Accountant?

An Audit Staff Accountant is an entry- to mid-level accounting professional who assists in auditing financial statements, evaluating internal controls, and ensuring compliance with regulations. These professionals work closely with senior auditors and managers to analyze financial data, identify risks, and provide recommendations for improving financial reporting processes. Their work helps businesses maintain accountability and transparency in financial operations.

At Aurora Financials, we specialize in providing remote auditing and accounting services to businesses across New Zealand, including Christchurch and Hamilton. Our expertise in auditing ensures that companies meet regulatory requirements while enhancing their financial processes.

Key Responsibilities of an Audit Staff Accountant

Audit staff accountants perform various functions related to financial verification, risk assessment, and compliance. Their primary responsibilities include:

1. Conducting Financial Audits

Audit staff accountants review financial records, transactions, and statements to ensure they align with regulatory requirements and accounting standards such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). They assess the accuracy of financial data and identify potential errors or fraudulent activities.

2. Testing Internal Controls

Internal controls are mechanisms put in place to safeguard a company’s financial assets and ensure operational efficiency. Audit staff accountants evaluate these controls to determine their effectiveness in preventing fraud and financial misstatements. If weaknesses are identified, they provide recommendations for improvement.

3. Assisting with External Audits

When external audits are conducted by regulatory bodies or independent firms, audit staff accountants assist in gathering and organizing financial data. They collaborate with external auditors to provide necessary documentation and explanations, ensuring a smooth audit process.

4. Verifying Compliance with Tax Laws and Regulations

Tax compliance is a crucial aspect of financial auditing. Audit staff accountants ensure that businesses adhere to local, national, and international tax laws. They review tax filings, deductions, and payments to confirm compliance and identify areas where tax obligations can be optimized legally.

5. Preparing Audit Reports

After reviewing financial statements and conducting audits, audit staff accountants document their findings in detailed reports. These reports outline financial health, highlight discrepancies, and provide recommendations for corrective actions.

6. Analyzing Financial Data and Identifying Risks

Audit staff accountants examine financial data to assess business risks. They look for trends that could indicate potential financial distress or operational inefficiencies. By identifying risks early, they help organizations implement strategies to mitigate financial instability.

7. Collaborating with Accounting Teams

Since auditing is closely tied to accounting, audit staff accountants frequently work alongside accounting teams to cross-check financial records, validate transactions, and ensure accuracy in financial reporting.

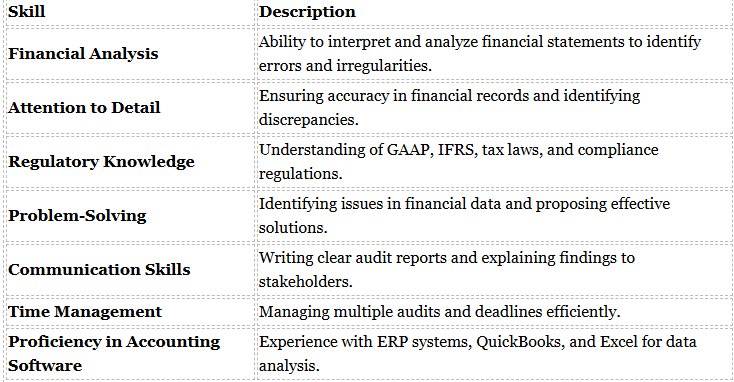

Required Skills for an Audit Staff Accountant

To succeed in this role, audit staff accountants must possess a combination of technical accounting knowledge and analytical skills. Some of the essential skills include:

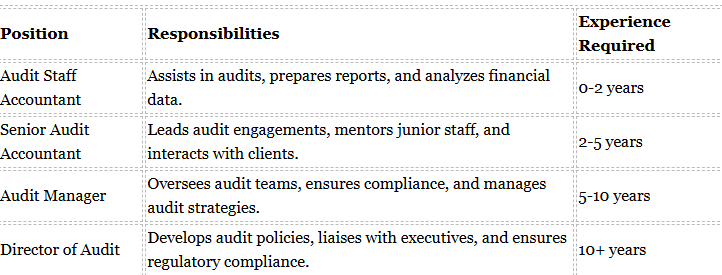

Career Path and Growth Opportunities

Audit staff accountants typically begin their careers in entry-level positions within accounting or auditing firms. Over time, they can advance to senior auditor roles and eventually to managerial or director positions. Below is a typical career progression:

For professionals looking to grow in this field, obtaining certifications such as Certified Public Accountant (CPA) or Chartered Accountant (CA) can significantly enhance career prospects and earning potential.

Why Choose Aurora Financials for Audit Services?

At Aurora Financials, we provide expert remote auditing and accounting services to businesses across New Zealand, including Christchurch and Hamilton. Our team of experienced professionals ensures compliance with regulatory requirements, strengthens internal controls, and delivers insightful financial reporting. Whether you are a small business or a large corporation, our tailored auditing solutions help enhance financial transparency and operational efficiency.

Importance of Audit Staff Accountants in Business

Audit staff accountants play a critical role in maintaining the financial health and integrity of an organization. Here are some of the key reasons why their work is essential:

1. Preventing Financial Fraud

By conducting thorough financial reviews, audit staff accountants help detect fraudulent activities such as embezzlement, financial misstatements, and unauthorized transactions. Their work contributes to financial transparency and protects businesses from financial losses.

2. Ensuring Regulatory Compliance

Governments and regulatory bodies impose strict financial reporting standards. Audit staff accountants ensure that businesses comply with these regulations, avoiding legal penalties and reputational damage.

3. Supporting Business Decision-Making

Accurate financial reporting allows business leaders to make informed decisions. Audit staff accountants provide insights into financial trends, helping companies plan for growth, manage costs, and allocate resources effectively.

4. Enhancing Investor and Stakeholder Confidence

Investors and stakeholders rely on accurate financial reports to assess a company’s performance. Audit staff accountants ensure that financial statements are credible, increasing investor confidence in the organization.

5. Improving Internal Controls

Strong internal controls are essential for operational efficiency. Audit staff accountants assess and strengthen these controls, reducing the risk of financial mismanagement.

Conclusion

An Audit Staff Accountant plays a vital role in ensuring financial accuracy, regulatory compliance, and risk management within an organization. Their expertise in financial analysis, auditing, and compliance helps businesses maintain transparency and credibility. Whether working for a public accounting firm or a private corporation, audit staff accountants are essential for safeguarding financial integrity.

For businesses seeking expert auditing solutions, Aurora Financials offers comprehensive remote auditing and accounting services across New Zealand. Our experienced team helps businesses stay compliant, mitigate financial risks, and enhance financial performance.

FAQs

1. What is the role of an Audit Staff Accountant?

An Audit Staff Accountant assists in financial audits, analyzes financial statements, evaluates internal controls, and ensures compliance with accounting regulations.

2. How much does an Audit Accountant make?

The average salary of an audit accountant varies based on experience, qualifications, and location. In New Zealand, an entry-level accountant may earn between NZD 55,000 and NZD 70,000 per year, while experienced professionals can earn upwards of NZD 100,000 annually.