When businesses search for an audit company near me, they are often looking for expert financial scrutiny, compliance assurance, and strategic risk management. Whether you run a small startup, a growing enterprise, or a large corporation, auditing is a crucial process that ensures financial integrity and regulatory compliance. This guide explores the role of audit firms, the benefits of hiring a professional auditing company, and how to choose the best audit firm for your business.

Understanding the Role of an Audit Company

Audit firms specialize in evaluating a company’s financial records, transactions, and internal controls. Their primary objectives include:

1. Ensuring compliance with accounting standards and regulations

2. Detecting and preventing financial fraud or discrepancies

3. Enhancing financial transparency and accountability

4. Providing insights for improved financial decision-making

Audit companies perform various types of audits, including financial audits, internal audits, tax audits, and compliance audits, depending on a business’s specific needs.

Benefits of Hiring a Professional Audit Company

1. Regulatory Compliance and Risk Mitigation

Businesses must adhere to local and international financial regulations. A professional audit company ensures that your organization meets these legal requirements, reducing the risk of penalties, fines, or legal actions.

2. Fraud Prevention and Detection

An external audit firm provides an unbiased review of financial statements and internal controls. This helps in identifying fraudulent activities, financial misstatements, and operational inefficiencies before they cause serious damage.

3. Improved Financial Transparency

Investors, stakeholders, and financial institutions require transparent and reliable financial statements. Auditors ensure that financial reports are accurate, instilling confidence in your business among shareholders and potential investors.

4. Optimized Business Performance

Auditing helps businesses identify inefficiencies, unnecessary expenses, and areas for cost-cutting. It provides valuable insights into financial health, enabling management to make informed strategic decisions.

5. Credibility and Trust

A certified audit from a reputable company boosts your credibility in the market. It reassures stakeholders that your financial records are accurate, improving business reputation and attracting potential partnerships.

Key Factors to Consider When Choosing an Audit Firm

1. Industry Experience and Expertise

Different industries have unique compliance requirements and financial structures. Choose an audit firm with experience in your industry to ensure they understand sector-specific regulations.

2. Certifications and Accreditation

Look for an audit company that holds certifications from recognized financial regulatory bodies. Certified auditors ensure high standards of professionalism and ethical conduct.

3. Service Offerings

Some audit firms specialize in specific services like forensic auditing or tax compliance audits. Ensure the firm you choose offers services tailored to your business needs.

4. Technology and Tools

Leading audit firms use advanced auditing software and data analytics tools to streamline the auditing process and improve accuracy. Check if the firm employs technology to enhance its services.

5. Reputation and Client Reviews

Research the firm’s reputation by reading client testimonials, online reviews, and case studies. A reputable firm with positive feedback is more likely to provide high-quality audit services.

6. Cost and Value Proposition

While cost is an important factor, prioritize value over price. A high-quality audit service can save your business from potential financial losses and legal issues.

How Aurora Financials Can Help

Aurora Financials is a trusted audit company near you, providing remote audit and accounting services to businesses across New Zealand. Our experienced auditors offer comprehensive financial assessments, ensuring compliance, accuracy, and financial integrity. We specialize in:

- Financial Audits to verify the accuracy of financial statements

- Internal Audits to improve internal controls and operational efficiency

- Tax Audits to ensure compliance with New Zealand’s tax regulations

- Risk Management Audits to identify and mitigate potential business risks

- Compliance Audits to help businesses meet industry regulations

The Auditing Process: What to Expect

Step 1: Initial Consultation

The process begins with an initial consultation to understand your business, its financial structure, and specific audit needs.

Step 2: Data Collection and Analysis

Auditors gather financial records, transaction histories, and compliance documents to analyze financial health and operational risks.

Step 3: Audit Execution

The auditing team conducts thorough evaluations, assessing internal controls, identifying discrepancies, and verifying compliance with regulatory standards.

Step 4: Reporting and Recommendations

Upon completion, auditors provide a detailed report outlining findings, discrepancies, and recommendations for financial improvements.

Step 5: Implementation Support

Many audit firms offer post-audit support, assisting businesses in implementing recommendations to enhance financial management.

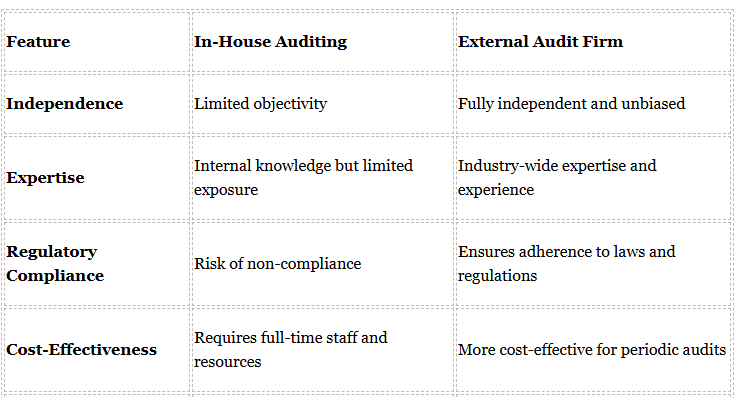

Comparison: In-House Auditing vs. External Audit Firms

Conclusion

Choosing the right audit company near me is essential for ensuring financial accuracy, compliance, and long-term business success. By hiring an experienced and professional audit firm, businesses can enhance financial transparency, mitigate risks, and improve operational efficiency. Aurora Financials offers remote audit services, helping businesses across New Zealand achieve financial excellence. Contact us today to schedule a consultation and take the first step toward a more secure financial future.

FAQs

1. What does an audit company do?

An audit company evaluates financial records, ensures regulatory compliance, and detects financial discrepancies to maintain financial integrity.

2. How often should a business conduct an audit?

Businesses should conduct annual audits, but the frequency may vary based on industry regulations, company size, and financial complexity.

3. Can a remote audit company provide the same quality as a local firm?

Yes, remote audit firms like Aurora Financials use advanced technology and expertise to deliver high-quality audit services regardless of location.

4. What industries need auditing services the most?

Industries such as finance, healthcare, manufacturing, and retail require regular audits to ensure compliance, accuracy, and fraud prevention.

5. How can I choose the best audit company near me?

Consider factors like industry experience, reputation, certifications, service offerings, and use of technology when selecting an audit firm.

Partner with Aurora Financials for expert audit services and ensure your business’s financial health and compliance.