Choosing the right accounting and audit services provider is a pivotal decision for businesses in Christchurch. Whether you run a small startup or a large corporation, selecting the right firm can significantly impact your financial management and strategic planning. If you’re searching for experienced professionals to support your financial needs, working with business accountants Christchurch can help ensure your business remains compliant and financially sound. Aurora Financials, a remote accounting and audit firm, offers solutions designed to meet diverse business requirements across New Zealand. This article explores the distinctions between small and large accounting firms, helping you determine the best fit for your business.

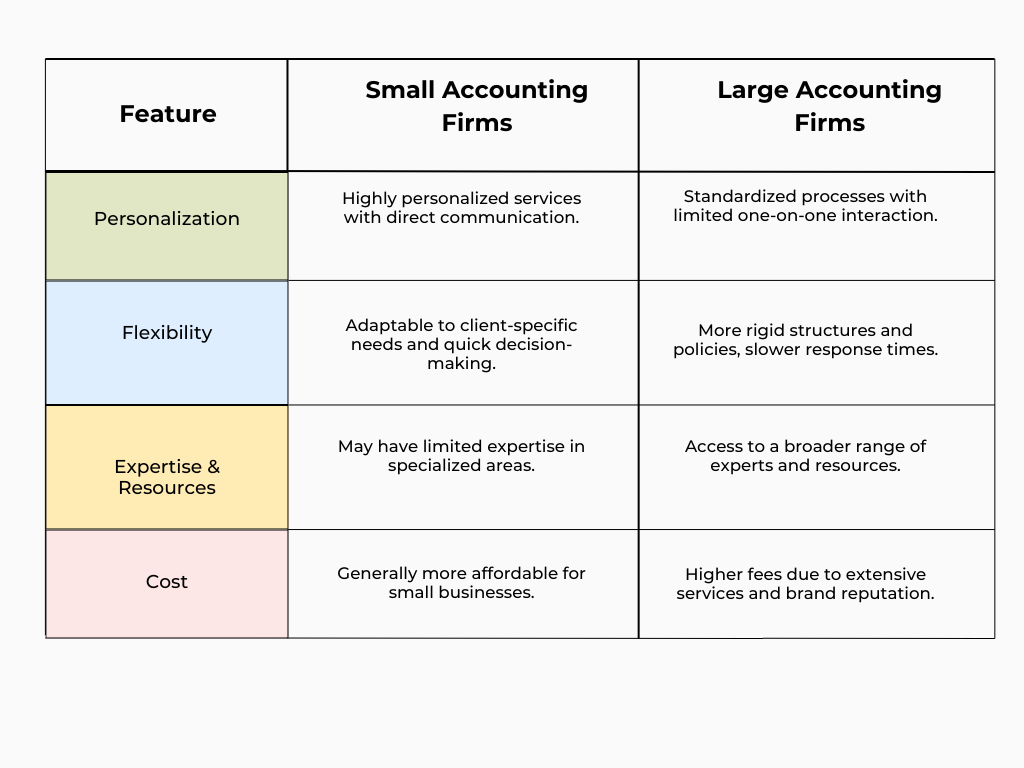

Comparison of Small and Large Accounting Firms

The table below highlights the key differences between small and large accounting firms to help you make an informed decision.

Benefits and Disadvantages of Small Accounting Firms

Benefits

1. Personalized Service: With fewer clients, small firms can offer more individualized attention, fostering strong relationships and a deep understanding of your business needs.

2. Flexibility: Smaller firms often adapt quickly to changes, providing customized solutions without the bureaucratic constraints of larger organizations.

3. Cost-Effectiveness: Lower overhead costs may translate to more affordable fees for clients, making quality accounting services accessible to small and medium-sized enterprises (SMEs).

4. Direct Access to Experts: Clients typically work directly with senior accountants, ensuring experienced guidance and expertise.

Disadvantages

1. Resource Limitations: Smaller teams might have limited capacity to handle complex or large-scale projects.

2. Specialization Constraints: They may offer a narrower range of services compared to larger firms.

3. Technology Gaps: Some small firms may not have access to the latest accounting software and automation tools.

Benefits and Disadvantages of Large Accounting Firms

Benefits

1. Comprehensive Services: Large firms provide a wide array of services under one roof, from auditing to consulting, accommodating diverse business needs.

2. Expertise and Experience: They attract top talent and possess extensive industry experience, ensuring high-quality service delivery.

3. Global Reach: For businesses operating internationally, large firms offer valuable insights into global markets and regulatory compliance.

4. Advanced Technology: Large firms invest in the latest accounting software, automation tools, and data analytics to improve efficiency and accuracy.

Disadvantages

1. Higher Fees: Extensive resources and brand reputation often come with increased service costs.

2. Less Personalized Attention: With a vast client portfolio, individualized service may be limited.

3. Bureaucratic Processes: Larger firms tend to have more rigid structures, leading to slower decision-making and less adaptability to unique client needs.

Aurora Financials: Bridging the Gap

Aurora Financials combines the personalized service of a small firm with the comprehensive offerings of a large firm. As a remote accounting and audit services provider, we cater to clients in Christchurch and throughout New Zealand, offering a range of services tailored to your business needs.

Our Services

We offer expert solutions in accounting and financial reporting, auditing and assurance, and consulting, ensuring businesses across New Zealand receive high-quality, customized support that enhances compliance, financial clarity, and strategic growth.

When deciding between small and large accounting firms, consider the following factors:

- Business Size and Complexity: Assess whether your operations require the extensive resources of a large firm or the personalized touch of a smaller one.

- Service Requirements: Identify the specific services you need and ensure the firm you choose can meet them effectively.

- Budget Constraints: Evaluate the cost of services in relation to your budget, seeking a balance between quality and affordability.

- Growth Plans: Consider your future expansion goals and whether the firm can scale services accordingly.

At Aurora Financials, our team of business accountants Christchurch specializes in providing tailored accounting and audit solutions that support your company’s growth and compliance requirements. By understanding the unique needs of businesses in Christchurch, we offer expert guidance that helps streamline your financial operations.

Conclusion

Selecting between small and large accounting firms in Christchurch depends on your unique business needs, objectives, and preferences. Aurora Financials offers a balanced approach, delivering personalized, comprehensive accounting and audit services remotely to clients across New Zealand. Partnering with us ensures you receive expert financial management tailored to your business, empowering you to focus on growth and success.

FAQs

1. What are the key differences between small and large accounting firms?

Small firms offer personalized, flexible services with potentially lower fees, while large firms provide comprehensive services, extensive expertise, and global reach.

2. How can I determine which type of accounting firm is right for my business?

Consider factors such as your business size, complexity, service needs, budget, and growth plans to make an informed decision.

3. What services does Aurora Financials provide?

Aurora Financials offers accounting and financial reporting, auditing and assurance, and consulting services tailored to businesses across New Zealand.

4. How does Aurora Financials deliver services remotely?

We utilize advanced technology and communication tools to provide efficient, secure, and personalized remote accounting and audit services to clients nationwide.

5. Can Aurora Financials accommodate the needs of both small and large businesses?

Yes, our team is equipped to handle the diverse requirements of businesses of all sizes, offering scalable solutions to support your growth and success.

6. How do I get started with Aurora Financials?

Visit our website at https://aurorafinancials.com to learn more about our services and request a free consultation.

7. What sets Aurora Financials apart from other accounting firms?

Our unique blend of personalized service, comprehensive offerings, remote capabilities, and commitment to client success distinguishes us in the industry.

8. Is Aurora Financials familiar with Christchurch’s local business environment?

Yes, we have extensive experience working with clients in Christchurch and across New Zealand, understanding the local market dynamics and regulatory landscape.

By working with business accountants Christchurch, like Aurora Financials, you ensure that your business receives expert support, strategic insights, and top-tier accounting solutions to drive success.