Filing a tax return is a crucial responsibility for individuals in New Zealand. Ensuring compliance with the Inland Revenue Department (IRD) allows taxpayers to determine whether they are entitled to a refund or have outstanding tax liabilities. Many individuals may not be required to file a return, but certain conditions mandate filing an IR3 tax return.

At Aurora Financials, we specialize in providing remote accounting and audit services to clients across New Zealand. We help individuals and businesses navigate their tax obligations efficiently and ensure compliance with New Zealand tax laws.

Understanding Tax Residency in New Zealand

Your tax obligations in New Zealand depend on whether you are classified as a tax resident or a non-resident. The IRD determines residency based on two key tests:

1. Physical Presence Test

You are considered a tax resident if you are present in New Zealand for more than 183 days within a 12-month period. These days do not have to be consecutive.

2. Permanent Place of Abode Test

Even if you do not meet the physical presence test, you may still be classified as a tax resident if you have a permanent place of abode in New Zealand. This means having strong ties to New Zealand, such as owning property or having family connections.

Understanding your tax residency status is essential as it determines your tax obligations and whether you need to file a return.

Who Needs to File an IR3 Tax Return?

Not everyone in New Zealand needs to file an IR3 tax return. However, if you meet any of the following conditions, you are required to file a return:

1. Self-Employed Individuals

If you are self-employed or operate as a sole trader, you must file an IR3 return to declare your income and expenses.

2. Rental Income Earners

If you earn income from rental properties, you need to file an IR3 tax return and report rental income, expenses, and depreciation claims.

3. Individuals with Overseas Income

If you receive foreign income, such as overseas investments, pensions, or earnings, you must declare this income on your New Zealand tax return.

4. Untaxed Income Earners

If you receive income that has not been taxed at the source, such as contract work, freelancer payments, or cash jobs, you are required to file an IR3 tax return.

5. Multiple Jobs with Incorrect Tax Codes

If you have worked multiple jobs during the year and have not used the correct secondary tax codes, you may need to file an IR3 tax return to ensure you have paid the correct amount of tax.

6. Interest, Dividends, or Royalty Income Over $200

If you earn more than $200 from interest, dividends, or royalties, you must declare this income in an IR3 return.

7. Part-Year Tax Residency

If you have entered or left New Zealand during the tax year, you may be required to file an IR3 return to account for the income earned while you were a tax resident.

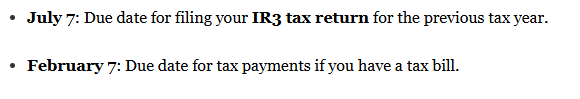

Important Tax Filing Deadlines

The New Zealand tax year runs from April 1 to March 31. It is crucial to keep track of the following deadlines:

If you use a registered tax agent, you may qualify for an extension of time to file your tax return.

How to File an IR3 Tax Return

There are two main ways to file your IR3 tax return in New Zealand:

1. Online Filing via myIR

The IRD’s myIR portal is the easiest way to file your tax return electronically. This platform allows you to complete and submit your IR3 tax return, view your tax summary and payments and claim tax credits and deductions.

2. Paper Filing

If you prefer, you can file your tax return using a physical IR3 form and send it to the IRD by mail.

To ensure accurate filing, you should gather all necessary documents, including:

Common Tax Deductions and Credits

When filing your IR3 tax return, you may be eligible for deductions and tax credits, including:

1. Work-Related Expenses

You can claim expenses directly related to earning income, such as home office expenses if you work from home.

2. Charitable Donations

If you donate to approved charities, you can claim a tax credit for 33.33% of your donation.

3. Income Protection Insurance

Premiums paid for income protection insurance may be deductible.

Maintaining proper records is essential to substantiate these claims and avoid compliance issues.

Consequences of Not Filing a Tax Return

Failing to file your IR3 tax return when required can lead to serious consequences, including:

How Aurora Financials Can Assist You

At Aurora Financials, we provide professional remote accounting and audit services to individuals and businesses across New Zealand. Our team can assist you with:

Tax Return Preparation and Filing

Ensuring accurate and timely submission of your IR3 tax return.

Tax Planning and Advisory

Helping you structure your finances efficiently to optimize tax savings.

Audit Services

Conducting financial audits to ensure transparency and compliance.

Our remote service model allows us to assist clients nationwide, providing expert guidance tailored to your specific tax situation.

Conclusion

Understanding whether you need to file a tax return in New Zealand is essential for maintaining compliance and avoiding penalties. If you earn self-employed income, rental income, overseas income, or have multiple jobs, you are likely required to file an IR3 tax return.

At Aurora Financials, we simplify the process by offering remote accounting and audit services to help individuals and businesses navigate their tax obligations with confidence. Contact us today for professional assistance with your New Zealand tax return.

FAQs

1. What is an IR3 tax return?

An IR3 tax return is a form used to report income that has not been taxed at the source and declare additional income streams.

2. How do I know if I’m a tax resident in New Zealand?

You are considered a tax resident if you spend more than 183 days in New Zealand within a 12-month period or have a permanent place of abode in the country.

3. Can I claim tax deductions for home office expenses?

Yes, if you work from home, you may be able to claim home office expenses as a deduction.

4. What happens if I don’t file my tax return?

Failing to file your IR3 tax return can result in penalties, interest charges, and potential legal consequences.

5. How can Aurora Financials help with my tax return?

We provide expert tax preparation, filing services, and advisory support, ensuring your tax obligations are met accurately and efficiently.