Understanding New Zealand’s Tax System

Understanding New Zealand’s tax system is crucial for individuals and businesses to ensure compliance and optimize financial outcomes. The primary components of this system include Goods and Services Tax (GST), Pay as You Earn (PAYE), and Income Tax. At Aurora Financials, we specialize in providing remote accounting and audit services with our expert tax advisor in nz, assisting clients in effectively managing these tax obligations.

Understanding Goods and Services Tax (GST)

Goods and Services Tax (GST) is a value-added tax applied to most goods and services supplied in New Zealand. The standard GST rate is 15%, and businesses registered for GST must collect this tax from customers and remit it to Inland Revenue.

GST Registration and Compliance

Businesses with an annual turnover exceeding NZD 60,000 are required to register for GST. Once registered, businesses must:

Failure to register or comply with GST obligations can result in penalties and interest charges from Inland Revenue.

Zero-Rated and Exempt Supplies

Not all goods and services are taxed at the standard 15% rate. Some transactions are zero-rated, meaning they are taxed at 0%, while others are exempt from GST entirely.

Businesses dealing with zero-rated or exempt supplies must understand how these categories impact their GST calculations and claims for input tax credits.

Pay As You Earn (PAYE) System

PAYE is the system employers use to deduct income tax and other deductions from employees’ wages or salaries. It ensures employees pay their tax obligations progressively throughout the year, avoiding large tax bills at the end of the tax year.

Employer Responsibilities

Employers must:

- Register as an employer with Inland Revenue before hiring staff.

- Deduct PAYE tax from employees’ gross pay based on their tax code.

- Remit PAYE deductions to Inland Revenue by the required due dates.

- Provide employees with pay slips detailing wages, tax deductions, and contributions to schemes like KiwiSaver.

- Keep accurate payroll records for auditing and compliance purposes.

Employers who fail to meet these obligations may face penalties, interest charges, or legal action.

Employee Considerations

Employees must ensure they provide the correct tax code to their employer. The tax code determines how much tax is deducted and depends on factors such as:

Using the wrong tax code can lead to underpayment or overpayment of taxes, requiring adjustments at the end of the tax year.

Income Tax in New Zealand

Income tax is levied on all income earned by individuals and businesses in New Zealand. The tax system is progressive, meaning the rate increases as income increases. Understanding these rates and compliance requirements is essential for tax planning and financial management.

Individual Income Tax Rates

As of the 2024/2025 tax year, individual income tax rates are as follows:

- 10.5% on income up to NZD 14,000.

- 17.5% on income between NZD 14,001 and NZD 48,000.

- 30% on income between NZD 48,001 and NZD 70,000.

- 33% on income between NZD 70,001 and NZD 180,000.

- 39% on income over NZD 180,000.

These rates apply to all taxable income, including salaries, wages, business profits, rental income, and investment earnings.

Business Income Tax

Businesses are also subject to income tax, with different rates and compliance requirements:

Understanding these tax obligations is essential for financial planning and compliance. Business owners must ensure proper record-keeping, expense tracking, and timely filing of tax returns.

Provisional Tax

Provisional tax applies to individuals and businesses with more than NZD 5,000 in residual income tax (income tax owed after PAYE deductions and credits). Instead of paying a lump sum at year-end, provisional tax is paid in installments throughout the year.

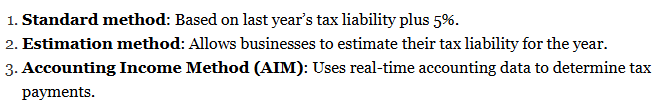

There are three main methods for calculating provisional tax:

Accurate provisional tax payments help businesses manage cash flow and avoid penalties for underpayment.

Aurora Financials: Your Tax Advisor in NZ

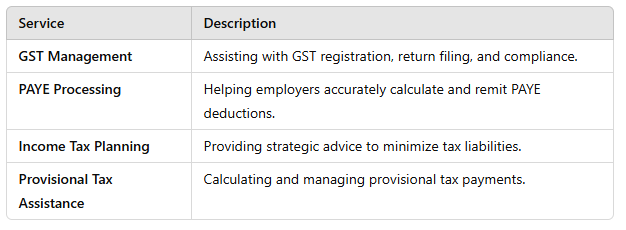

At Aurora Financials, we offer comprehensive remote accounting and audit services to clients across New Zealand. Our expertise ensures businesses and individuals comply with tax regulations while optimizing their financial position.

We provide:

Our remote service model allows us to support clients across New Zealand without the need for in-person meetings, making tax compliance accessible and efficient.

Conclusion: Tax Advisor NZ

Navigating New Zealand’s tax system requires a thorough understanding of GST, PAYE, and Income Tax obligations. Partnering with Aurora Financials ensures that you receive expert guidance tailored to your unique circumstances, helping you maintain compliance and optimize your financial position.

FAQs

1. What is the threshold for GST registration in New Zealand?

Businesses must register for GST if their annual turnover exceeds NZD 60,000. Once registered, they must charge 15% GST on sales, file regular returns, and remit collected tax to Inland Revenue. Voluntary registration is also an option for businesses below the threshold if it offers financial benefits.

2. How often do I need to file GST returns?

GST returns can be filed monthly, bi-monthly, or six-monthly, depending on turnover and preference. High-turnover businesses typically file monthly, while smaller businesses may opt for less frequent filing. Filing on time is crucial to avoid penalties and ensure compliance with Inland Revenue requirements.

3. What are the current individual income tax rates in New Zealand?

New Zealand follows a progressive tax system with rates from 10.5% to 39%, depending on income brackets. The highest rate applies to income over NZD 180,000. Salaried individuals typically have their tax deducted at source through PAYE, while business owners and freelancers must file tax returns.

4. How does PAYE work for employers and employees?

Employers deduct income tax, KiwiSaver contributions, ACC levies, and student loan repayments from employee wages. Employees must provide the correct tax code to ensure accurate deductions. PAYE helps distribute tax payments throughout the year, reducing the likelihood of large tax bills at year-end.

5. What is provisional tax, and who needs to pay it?

Provisional tax applies to businesses and individuals owing over NZD 5,000 in residual income tax. It allows tax payments in installments instead of a lump sum. Methods include standard, estimation, and AIM, helping businesses manage cash flow and avoid interest charges for underpayment.