Managing finances effectively is crucial for the success of any small business. In New Zealand, businesses must comply with accounting regulations while ensuring financial accuracy for long-term growth. Whether you are a startup or an established business, professional accounting services can help streamline financial processes, improve compliance, and provide valuable insights.

At Aurora Financials, we specialize in remote accounting and audit services, helping businesses across New Zealand manage their financial records efficiently. This guide explores the key aspects of small business accounting in NZ and how our expert services can benefit your business.

Importance of Small Business Accounting

1. Compliance with NZ Regulations

New Zealand businesses must adhere to financial regulations set by the Inland Revenue Department (IRD) and other authorities. Proper accounting ensures that businesses meet tax obligations, file accurate financial statements, and avoid penalties.

2. Financial Accuracy and Decision-Making

Accurate financial records help business owners make informed decisions. With clear financial data, businesses can identify profitability, control expenses, and plan for future growth.

3. Tax Efficiency and Planning

Small businesses must manage taxes efficiently to avoid overpaying and ensure compliance. Professional accounting services help businesses claim deductions, structure tax payments, and plan for GST, PAYE, and income tax obligations.

4. Cash Flow Management

Effective cash flow management ensures businesses maintain liquidity to cover operational expenses. Accounting professionals help track income, expenses, and outstanding invoices to optimize cash flow.

Key Accounting Services for Small Businesses

1. Bookkeeping Services

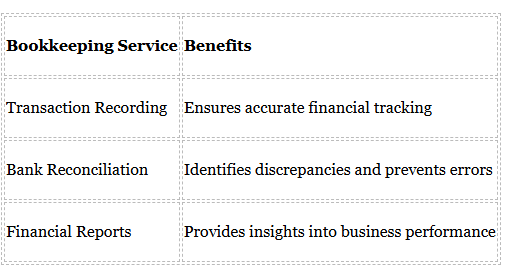

Regular bookkeeping is essential for maintaining accurate financial records. Our services include:

2. Payroll Management

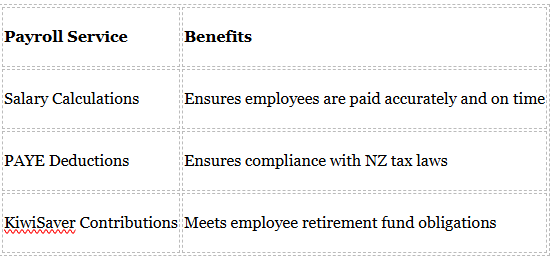

Small businesses with employees need efficient payroll systems to comply with NZ employment laws. Our payroll services ensure:

3. GST and Tax Compliance

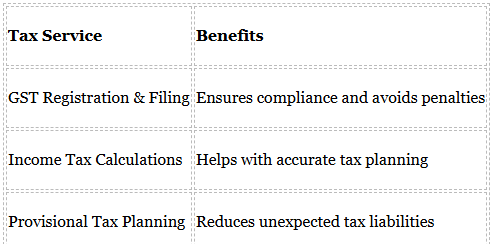

Filing GST returns and managing business taxes can be complex. We assist with:

4. Financial Reporting and Analysis

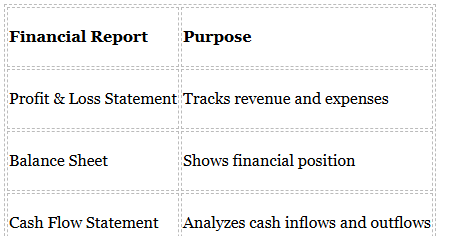

We provide comprehensive financial reports to help businesses understand their financial health. Our services include:

5. Audit and Assurance Services

Ensuring transparency and compliance, our remote audit services help businesses maintain accurate records and meet regulatory requirements.

Why Choose Aurora Financials for Small Business Accounting?

1. Remote Accounting Expertise

We offer seamless remote accounting services, allowing businesses across NZ to access expert financial management without geographical restrictions.

2. Cost-Effective Solutions

Outsourcing accounting services saves costs compared to hiring in-house accountants. We provide tailored solutions to fit your budget and business needs.

3. Advanced Technology Integration

We use cloud-based accounting tools, ensuring secure data storage, real-time financial tracking, and streamlined accounting processes.

4. Personalized Support

Our team provides ongoing support and financial insights, helping small businesses stay compliant and financially healthy.

Conclusion

Small business accounting in NZ is essential for maintaining compliance, managing cash flow, and optimizing financial performance. Aurora Financials offers expert remote accounting services to help businesses across New Zealand navigate their financial responsibilities with ease. Contact us today to learn how we can support your business’s financial success.

FAQs

1. What accounting services does a small business need?

Small businesses require bookkeeping, payroll management, tax compliance, financial reporting, and audit services to maintain accurate records and stay compliant with NZ regulations. Proper accounting helps businesses optimize cash flow, ensure tax efficiency, and improve financial decision-making.

2. How can remote accounting benefit my small business?

Remote accounting allows businesses to access expert financial management without needing in-house staff, reducing costs and improving efficiency. It also provides flexibility, real-time data access through cloud-based systems, and secure financial tracking, making it an ideal solution for small businesses in NZ.

3. Do I need an accountant for my small business in NZ?

Hiring an accountant ensures compliance with tax laws, accurate financial reporting, and better financial decision-making. An accountant helps businesses avoid costly errors, maximize deductions, and structure their finances for long-term growth, making it a valuable investment.

4. What is the best accounting software for small businesses in NZ?

Popular accounting software options in NZ include Xero. We assist businesses in choosing and managing the right software for their needs, ensuring seamless financial management and compliance with local regulations.

5. How can I get started with Aurora Financials’ accounting services?

Simply contact us through our website to schedule a consultation. We’ll assess your needs and provide a customized accounting solution for your business, ensuring compliance, efficiency, and financial success.