Financial management is the backbone of every successful business in New Zealand. It’s not just about crunching numbers—it’s about making smart decisions that keep your business thriving. From managing cash flow to staying compliant with tax laws, financial management ensures stability and long-term growth. Without a solid financial strategy, businesses risk falling into debt, missing opportunities, or even facing penalties from regulatory bodies. This article explores essential strategies of financial management in NZ, helping businesses navigate the complexities of budgeting, taxation, compliance, and investment in New Zealand’s dynamic economic landscape.

Understanding Financial Management in New Zealand

Financial management in NZ isn’t just for large corporations; it’s crucial for small businesses too. Whether you’re a startup or an established company, managing your finances effectively means planning ahead, cutting unnecessary costs, and making informed decisions. Businesses in New Zealand must also adhere to regulatory frameworks set by the Inland Revenue (IRD) and the External Reporting Board (XRB). Ignoring these regulations can lead to costly fines, legal troubles, and reputational damage.

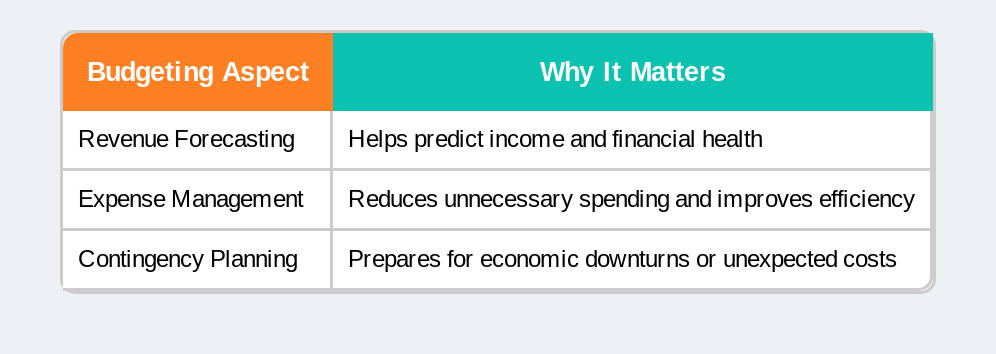

Budgeting and Financial Planning

Think of a budget as your business’s roadmap. Without it, you’re driving blind. A well-structured budget helps allocate resources wisely, control expenses, and set financial goals. Businesses must evaluate revenue streams, anticipate costs, and prepare for uncertainties.

Beyond budgeting, financial planning involves monitoring industry trends, adjusting spending patterns, and setting long-term financial objectives. Companies that proactively analyze market shifts are better prepared to handle fluctuations in revenue and expenses.

Managing Cash Flow Effectively

Cash flow issues are one of the biggest reasons businesses fail. A company can be profitable on paper but still struggle if cash is tied up in unpaid invoices or unnecessary expenses. To keep cash flowing smoothly:

- Set clear payment terms and follow up on overdue invoices promptly.

- Reduce expenses by cutting non-essential costs and negotiating with suppliers.

- Build an emergency fund to cover unexpected financial shortfalls.

Companies that manage their cash flow efficiently have greater flexibility in making strategic investments, expanding operations, and navigating economic downturns.

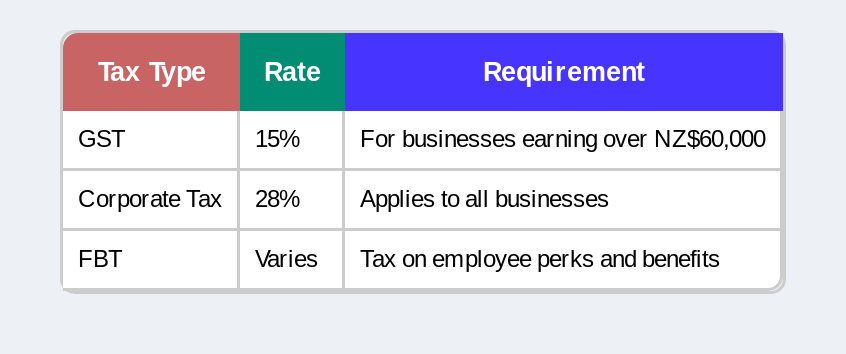

Tax Compliance in New Zealand

New Zealand’s tax system is straightforward but demands strict compliance. Businesses must register for Goods and Services Tax (GST) if annual turnover exceeds NZ$60,000. GST returns need to be filed regularly, and late submissions can result in fines.

To avoid penalties, businesses should maintain accurate financial records, file tax returns on time, and seek professional advice when needed. Engaging an accountant can help optimize tax deductions and ensure compliance with evolving tax laws.

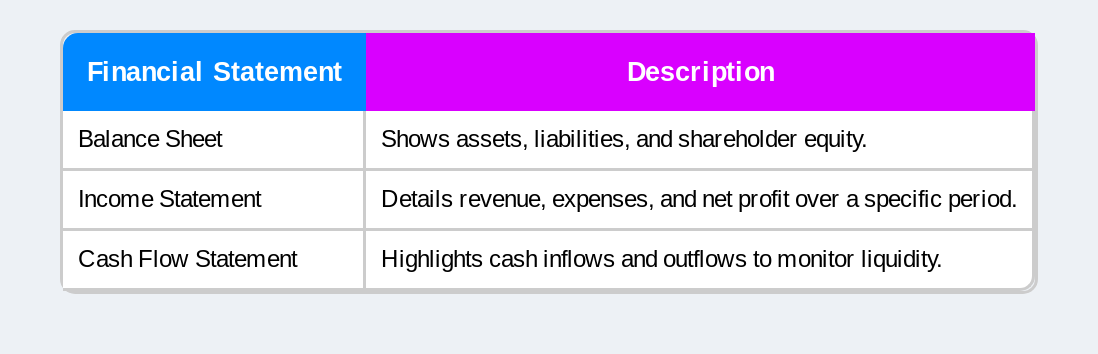

Financial Reporting and Regulatory Compliance

Financial reporting isn’t just a bureaucratic requirement—it’s a tool for making smarter business decisions. A well-prepared financial report provides insights into profitability, cash flow, and overall financial health.

Businesses that neglect financial reporting may struggle with audits, regulatory penalties, and investor distrust. Adopting automated accounting software simplifies reporting processes, ensuring accuracy and compliance with local laws.

Investment Strategies for Business Growth

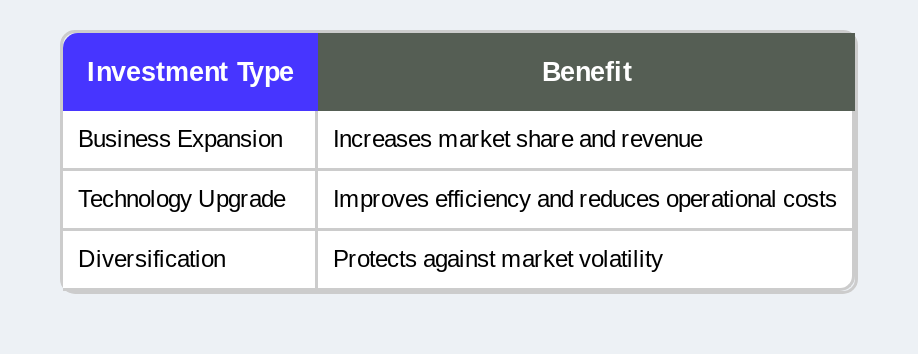

Want to grow your business? Investing wisely is key. Businesses that reinvest profits into expansion, technology, or new product development gain a competitive edge. But investment decisions should be data-driven, not impulsive.

Companies should also explore funding options such as bank loans, government grants, or venture capital. However, it’s essential to assess the risks and returns before committing to any investment.

Conclusion

Financial management in NZ is not just about balancing the books—it’s about ensuring long-term success. Effective budgeting, cash flow management, tax compliance, and smart investment strategies can set businesses on the path to sustainable growth. New Zealand businesses that embrace proactive financial planning are better positioned to navigate economic uncertainties and capitalize on opportunities. If you need professional guidance, Aurora Financials offers expert financial solutions to help businesses streamline operations and stay compliant. Contact us today to learn how we can support your financial journey.

Frequently Asked Questions (FAQ)

1. Why is financial management important for businesses in New Zealand?

It ensures financial stability, compliance with tax laws, and strategic growth opportunities, helping businesses avoid financial pitfalls.

2. How can businesses improve cash flow management?

By setting clear payment terms, reducing unnecessary expenses, and maintaining an emergency fund, businesses can ensure consistent cash flow.

3. What are the tax obligations for businesses in New Zealand?

Businesses must register for GST if annual turnover exceeds NZ$60,000, file regular tax returns, and pay corporate tax at 28%.

4. How does financial reporting benefit a business?

It enhances transparency, aids in decision-making, and ensures regulatory compliance, which boosts investor and stakeholder confidence.

5. What are the best investment strategies for business growth?

Reinvesting in expansion, technology, and diversification helps businesses scale and adapt to market changes efficiently.